Dealer Inventory Scorecard

You can process a Dealer Inventory Scorecard report to determine:

If your current inventory is overstocked/understocked based on the current inventory value and the inventory turn rate.

If your parts are overstocked/understocked based on purchases and usage.

If your supplies are overstocked/understocked based on purchases and usage.

The monetary value and percentage of your inventory that is dead inventory.

How your current percentage of rescheduled service calls compares with your target percentage of rescheduled service calls.

The monthly monetary impact of rescheduled service calls on your business.

You specify report parameters that identify the items in your inventory defined as parts and the items in your inventory defined as supplies, the time period for which you want to run the report (which should be one quarter in length), the period of time in months after which to consider an in-stock inventory item dead if the item has not been used or received into inventory, and the impact of rescheduled calls on your business.

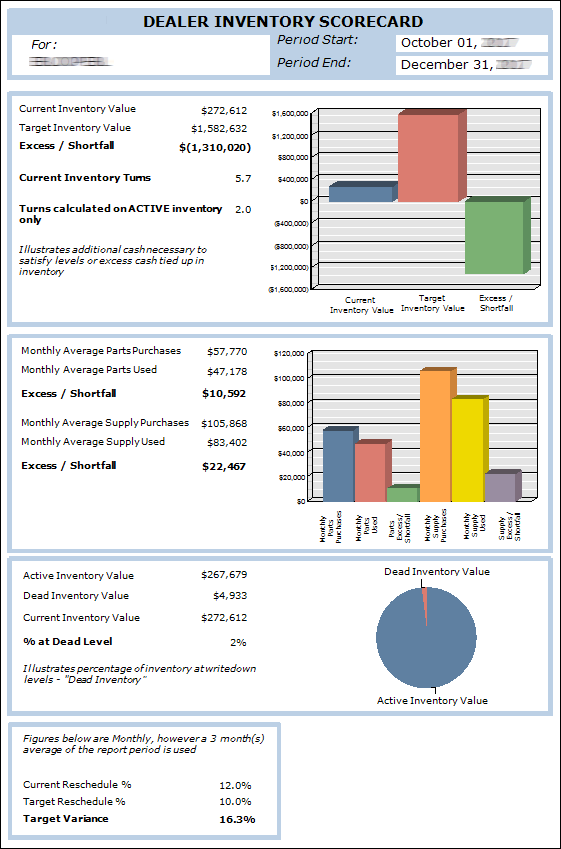

The main report includes the following information:

Current Inventory Value Metrics: Current Inventory Value*, Target Inventory Value*, Excess/Shortfall*, Current Inventory Turns, and Turns Calculated on Active Inventory Only.

Current Inventory Purchase and Usage Metrics: Monthly Average Parts Purchases*, Monthly Average Parts Used*, Parts Excess/Shortfall*, Monthly Average Supply Purchases*, Monthly Average Supplies Used*, and Supplies Excess/Shortfall*.

Dead Inventory Metrics: Active Inventory Value ♦ , Dead Inventory Value ♦ , Current Inventory Value ♦ , and % at Dead Level.

Rescheduled Service Call Metrics: Current Reschedule %, Target Reschedule %, and Target Variance.

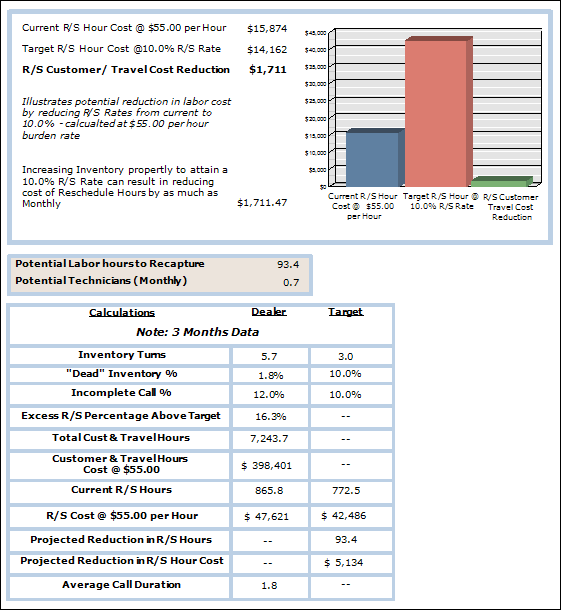

Monthly Monetary Impact of Rescheduled Service Calls: Current Cost of Rescheduled Service Calls*, Target Cost of Rescheduled Service Calls*, and Rescheduled Call Customer and Travel Cost Reduction that could be achieved by increasing technician inventory*.

Labor Impact of Rescheduled Service Calls: Potential Labor Hours to Recapture (based on report's time period) and Potential Technicians that could be saved per month if all rescheduled calls were eliminated.

Calculations and/or Comparison of Actual Values to Target Values: Inventory Turns, "Dead" Inventory %, Incomplete Call %, Excess Rescheduled Service Call Percentage Above Target, Total Customer and Travel Hours, Customer and Travel Hours Cost, Current Rescheduled Service Call Hours, Monetary Value of Rescheduled Service Calls, Projected Reduction in Rescheduled Service Call Hours, Projected Reduction in Rescheduled Service Call Cost, and Average Call Duration.

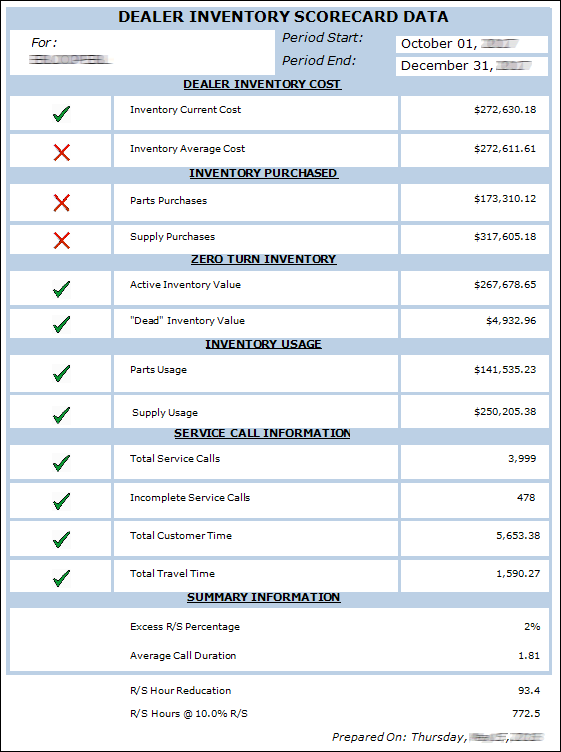

Summary Detail:

Dealer Inventory Cost: Inventory Current Cost^ and Inventory Average Cost^

Inventory Purchased: Parts Purchased^ and Supplies Purchased^

Zero Turn Inventory: Active Inventory Value^ and "Dead" Inventory Value^

Inventory Usage: Parts Usage^ and Supply Usage^

Service Call Information: Total Service Calls^, Incomplete Service Calls^, Total Customer Time^, and Total Travel Time^

Summary Information: Excess Rescheduled Service Call Percentage and Average Call Duration

Rescheduled Service Call Hour Reduction

Rescheduled Service Call Hours at Target Percentage of Rescheduled Service Calls

This report offers drill-down capabilities. You can access Dealer Inventory Cost Details, Inventory Purchased Details, Dead Inventory (Zero Inventory Turn) Details, Inventory Usage Details, and Service Call Details sub reports by double clicking in the corresponding tables on the third page of the main report. Additionally, you can access an Inventory Purchased Details (Transaction-level) sub report from the Inventory Purchased Details sub report.

Getting to the ReportGetting to the Report

Log in to e-automate with appropriate permissions.

Click [Reports] to open the Report Console window.

In the left pane, click Inventory.

In the right pane, double-click Dealer Inventory Scorecard to open the Dealer Inventory Scorecard window.

Setting Report ParametersSetting Report Parameters

When setting report parameters, each parameter you have selected displays in the upper portion of the right pane. The parameters do not reset. The report displays with the parameters that were set the last time you ran the report. You can use the following parameters:

Define PartsDefine Parts

Use the Define Parts filter to include in the report the items in your inventory defined as parts (e.g., use the advanced filter option to filter for select all items with a Category of P for Parts).

To filter for items defined as parts, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Define Parts to display the Define Parts region in the right pane.

Do one of the following:

If you want to indicate all items are defined as parts, in the Define Parts region, check the Include all Define Parts checkbox.

If you want to specify the range of items that are defined as parts, do the following:

Uncheck the Include all Define Parts checkbox.

In the From field, enter the beginning item defined as a part or use the lookup to select an item defined as a part.

In the To field, enter the ending item defined as a part or use the lookup to select an item defined as a part.

If you want to select items defined as parts using the advanced filter, do the following:

Uncheck the Include all Define Parts checkbox.

Check the Use advanced filter box.

Click the [Advanced filter] button to open the Define Parts window.

Use the QuickSearch functionality to filter for the items defined as parts you want to include in the report. For information on using QuickSearch functionality, see the Using the QuickSearch topic.

When the Define Parts window displays the items defined as parts you want to include in the report, click [OK] to return to the Dealer Inventory Scorecard window.

Define SuppliesDefine Supplies

Use the Define Supplies filter to include in the report the items in your inventory defined as supplies (e.g., use the advanced filter option to filter for select all items with a Category of S for Supplies).

To filter for items defined as supplies, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Define Supplies to display the Define Supplies region in the right pane.

Do one of the following:

If you want to include all items defined as supplies, in the Define Supplies region, check the Include all Define Supplies checkbox.

If you want to select a range of items defined as supplies, do the following:

Uncheck the Include all Define Supplies checkbox.

In the From field, enter the beginning item defined as a supply or use the lookup to select an item defined as a supply.

In the To field, enter the ending item defined as a supply or use the lookup to select an item defined as a supply.

If you want to select items defined as supplies using the advanced filter, do the following:

Uncheck the Include all Define Supplies checkbox.

Check the Use advanced filter box.

Click the [Advanced filter] button to open the Define Supplies window.

Use the QuickSearch functionality to filter for the items defined as supplies you want to include in the report. For information on using QuickSearch functionality, see the Using the QuickSearch topic.

When the Define Supplies window displays the items defined as supplies you want to include in the report, click [OK] to return to the Dealer Inventory Scorecard window.

Date Range (calculations are based on a three-month date range)Date Range (calculations are based on a three-month date range)

You can define the date range to run the report for any time period, but the report is optimized to be run for a time period of three months (one quarter). Some of the report calculations will only be accurate if you run the report for a three-month period.

To filter by date range, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Date Range... to display the Date Range (calculations are based on a three-month date range) region in the right pane.

Do one of the following:

To include all dates, in the Date Range (calculations are based on a three-month date range) region, use the drop-down menu to select <All Dates>.

To use a pre-defined date range, in the Date Range (calculations are based on a three-month date range) region, use the drop-down menu to select a pre-configured date option (e.g., Last Fiscal Quarter).

To specify a custom date range, do the following:

In the Date Range (calculations are based on a three-month date range) region, use the drop-down menu to select <Custom>.

In the From field, enter the beginning date or use the drop-down calendar to select a date.

In the To field, enter the ending date or use the drop-down calendar to select a date.

Dead Inventory Use MonthsDead Inventory Use Months

Use the Dead Inventory Use Months filter to indicate the time period that must elapse for you to consider an inventory item to be dead if it has not been used in a sales order, service call, or work order during that period. The default value is 18 months, but you can override this value if desired. The system searches for dead inventory using the number of months you specify and counting backward in time from the end date you specify for the report.

To specify the number of months to search usage for dead inventory from the end date you specify for the report, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Dead Inventory Use Months to display the Dead Inventory Use Months region in the right pane.

In the Dead Inventory Use Months field, enter the number of months from the report's end date that must elapse before you consider an inventory item to be dead inventory.

Dead Inventory Receipt MonthsDead Inventory Receipt Months

Use the Dead Inventory Receipt Months filter to indicate the time period that must elapse for you to consider an inventory item to be dead if it has not been received into inventory during that period. The default value is 18 months, but you can override this value if desired. The system searches for dead inventory using the number of months you specify and counting backward in time from the end date you specify for the report.

To specify the number of months to search receipts for dead inventory from the end date you specify for the report, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Dead Inventory Receipt Months to display the Dead Inventory Receipt Months region in the right pane.

In the Dead Inventory Receipt Months field, enter the number of months from the report's end date that must elapse before you consider an inventory item to be dead inventory if the item has not been included on an inventory receipt.

Rescheduled Hour CostRescheduled Hour Cost

Use the Rescheduled Hour Cost to identify the average cost-per-hour of a rescheduled call (e.g., the average cost-per-hour of having a technician service equipment). The report uses this parameter together with the Target Reschedule Percentage and Monthly Technician Hours parameters to determine the impact of rescheduled calls.

To specify the average cost-per-hour of a rescheduled call, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Rescheduled Hour Cost to display the Rescheduled Hour Cost region in the right pane.

In the Rescheduled Hour Cost field, enter the monetary amount representing the average cost-per-hour of a rescheduled call. The default value is $65.00, but you can override this value.

Target Reschedule PercentageTarget Reschedule Percentage

Use the Target Reschedule Percentage to identify the percentage of service calls that you do not want rescheduled calls to exceed. The report uses this parameter together with the Rescheduled Hour Cost and Monthly Technician Hours parameters to determine the impact of rescheduled calls.

To specify the percentage of service calls that you do not want rescheduled calls to exceed, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Target Reschedule Percentage to display the Target Reschedule Percentage region in the right pane.

In the Target Reschedule Percentage field, specify the percentage of service calls that you do not want rescheduled calls to exceed.

Monthly Technician HoursMonthly Technician Hours

Use the Monthly Technician Hours to specify the average number of hours one technician can work in a given month. The report uses this parameter together with the Rescheduled Hour Cost and Target Reschedule Percentage parameters to determine the impact of rescheduled calls.

To specify the average number of hours one technician can work in a given month, do the following:

In the left pane of the Dealer Inventory Scorecard window, select Monthly Technician Hours to display the Monthly Technician Hours region in the right pane.

In the Monthly Technician Hours field, specify the average number of hours one technician can work in a given month.

Processing the ReportProcessing the Report

On the Dealer Inventory Scorecard window, click [OK] to process the report.

Viewing Sub ReportsViewing Sub Reports

Using the main report's drill-down capabilities, you can view Dealer Inventory Cost Details, Inventory Purchased Details, Dead Inventory Details (Zero Inventory Turn), Inventory Usage Details, and Service Call Details sub reports.

Dealer Inventory Cost Details Sub ReportDealer Inventory Cost Details Sub Report

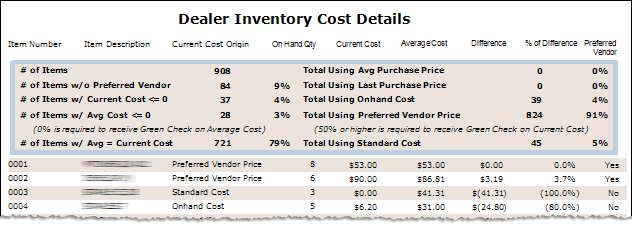

The Dealer Inventory Cost Details sub report includes the following information:

Dealer Inventory Cost Summary Details: # of Items, # of Items w/o Preferred Vendor, # of Items w/ Current Cost <= 0, # of Items w Avg Cost <= 0, # of Items w/ Avg = Current Cost, Total Using Avg Purchase Price, Total Using Last Purchase Price, Total Using Onhand Cost, Total Using Preferred Vendor Price, Total Using Standard Cost

Item Purchased Details: Item Number, Item Description, Current Cost Origin, On Hand Qty, Current Cost, Average Cost, Difference, % of Difference, Preferred Vendor (Yes/No)

To view the Dealer Inventory Cost Details sub report, do the following:

Go to the last page of the report.

Double-click anywhere in the Dealer Inventory Cost table to have the system display the sub report.

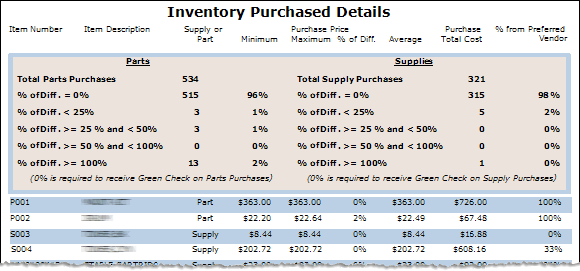

Inventory Purchased Details Sub ReportInventory Purchased Details Sub Report

Inventory Purchased Details (Item-level) Sub Report Inventory Purchased Details (Item-level) Sub Report

The Inventory Purchased Details (Item-level) sub report includes the following information:

Item Purchased Summary Details:

Parts: Total Parts Purchases, % of Diff. = 0%, % of Diff. >= 0% and < 25%, % of Diff. >= 25% and < 50%, % of Diff. >= 50% and < 100%, % of Diff. >= 100%

Supplies: Total Supplies Purchases, % of Diff. = 0%, % of Diff. >= 0% and < 25%, % of Diff. >= 25% and < 50%, % of Diff. >= 50% and < 100%, % of Diff. >= 100%

Item Purchased Details: Item Number, Item Description, Supply or Part, Minimum (Purchase Price), Maximum (Purchase Price), % of Diff., Average, Purchase Total Cost, % from Preferred Vendor

To view the Inventory Purchased Details (Item-level) sub report, do the following:

Go to the last page of the report.

Double-click anywhere in the Inventory Purchased table to have the system display the sub report.

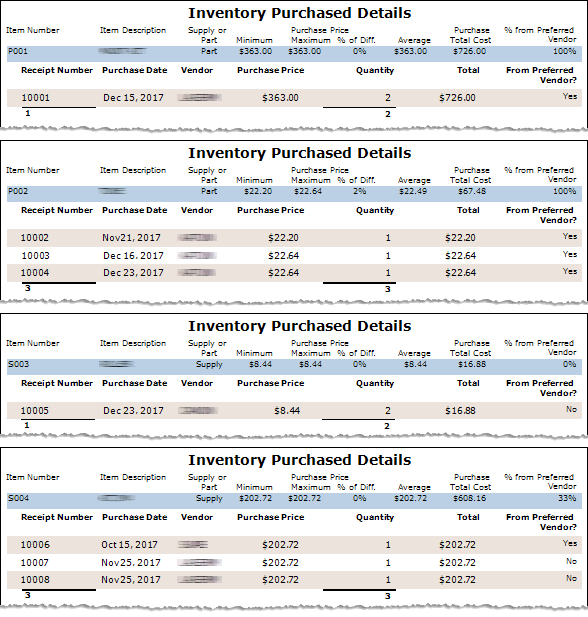

Inventory Purchased Details (Transaction-level) Sub Report Inventory Purchased Details (Transaction-level) Sub Report

The Inventory Purchased Details (Transaction-level) sub report includes the following information:

Item Purchased Details Summary Row: Item Number, Item Description, Supply or Part, Minimum (Purchase Price), Maximum (Purchase Price), % of Diff., Average, Purchase Total Cost, % from Preferred Vendor

Item Purchased Details Summary Row: Item Number, Item Description, Supply or Part, Minimum (Purchase Price), Maximum (Purchase Price), % of Diff., Average, Purchase Total Cost, % from Preferred Vendor

To view the Inventory Purchased Details (Transaction-level) sub report, do the following:

Go to the last page of the report.

Double-click anywhere in the Inventory Purchased table to have the system display the sub report.

Double-click any detail row in the report to view the transaction-level detail for that row.

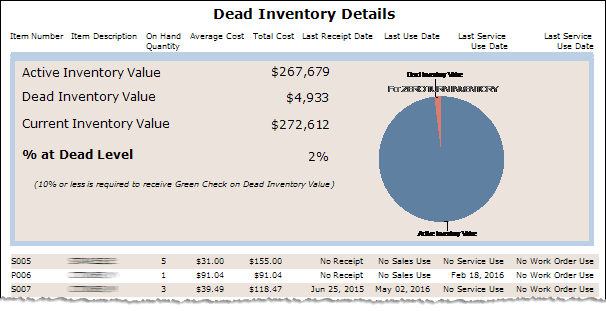

Dead Inventory Details (Zero Inventory Turn) Sub ReportDead Inventory Details (Zero Inventory Turn) Sub Report

The Dead Inventory Details (Zero Inventory Turn) sub report includes the following information:

Dead Inventory Summary Details: Active Inventory Value, Dead Inventory Value, Current Inventory Value, % at Dead Level, Pie Chart Graph of % at Zero Inventory Turn (Dead Inventory Value) level.

Dead Inventory Item Details: Item Number, Item Description, On Hand Quantity, Average Cost, Last Receipt Date, Last Use Date, Last Service Use Date, Last Work Order Use Date.

To view the Dead Inventory Details (Zero Inventory Turn) sub report, do the following:

Go to the last page of the report.

Double-click anywhere in the Zero Inventory Turn table to have the system display the sub report.

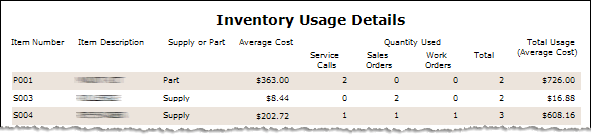

Inventory Usage Details Sub ReportInventory Usage Details Sub Report

The Inventory Usage Details sub report includes the following information:

Item Detail: Item Number, Item Description, Supply or Part, Average Cost, Service Calls (Quantity Used), Sales Orders (Quantity Used), Work Orders (Quantity Used), Total (Quantity Used), Total Usage (Average Cost)

Totals for Invoiced Call: If a call has been invoiced (Status = Invoiced), the system lists the following totals on separate rows below the call: Total Labor Hours, Total Overtime Hours, Total Interrupt Hours, Total Travel Hours, and overall Total Hours.

To view the Inventory Usage Details sub report, do the following:

Go to the last page of the report.

Double-click anywhere in the Inventory Usage table to have the system display the sub report.

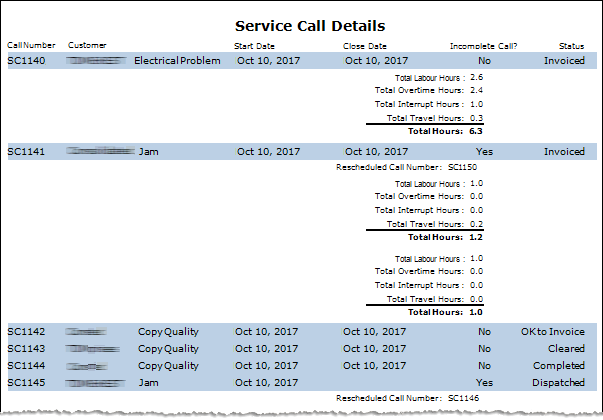

Service Call Details Sub ReportService Call Details Sub Report

The Service Call Details sub report includes the following information:

Service Call Detail: Call Number, Customer Name, Call Description, Start Date, Close Date, Incomplete Call? (Yes/No), and Status (Cleared, OK to Invoice, Invoiced). If a call is marked incomplete (Incomplete Call? = Yes), the Rescheduled Call Number displays on a separate row below the call that was marked incomplete.

Totals for Invoiced Call: If a call has been invoiced (Status = Invoiced), the system lists the following totals on separate rows below the call: Total Labor Hours, Total Overtime Hours, Total Interrupt Hours, Total Travel Hours, and overall Total Hours.

To view the Service Call Details sub report, do the following:

Go to the last page of the report.

Double-click anywhere in the Service Call Information table to have the system display the sub report.

Understanding Report CalculationsUnderstanding Report Calculations

Main ReportMain Report

Following is a sample of the main Dealer Inventory Scorecard report. This report was processed for one fiscal quarter and includes all parts with an Item Category of P (Parts) and all supplies with an item Category of S (Supplies). The table below this sample report identifies the source of each of the numbers and/or the calculations for arriving at the numbers in the report. The additional sections of this topic provide similar information for each of the sub reports.

Main Report Images

The following table identifies the source of each of the numbers and/or the calculations for arriving at the numbers in the main Dealer Inventory Scorecard report.

|

Report Label |

Description and/or Calculation |

|

Current Inventory Value Metrics |

|

|

The total inventory average cost (inventory quantity * average cost) of the items included in the Define Parts and Define Supplies parameters you specified for the report.

Calculation: Current Inventory Value = Sum(Inventory Quantity * Average Cost for Each Item Included in Report)

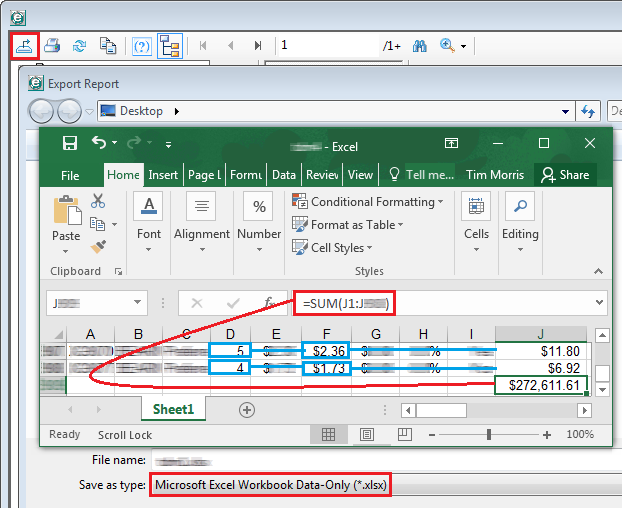

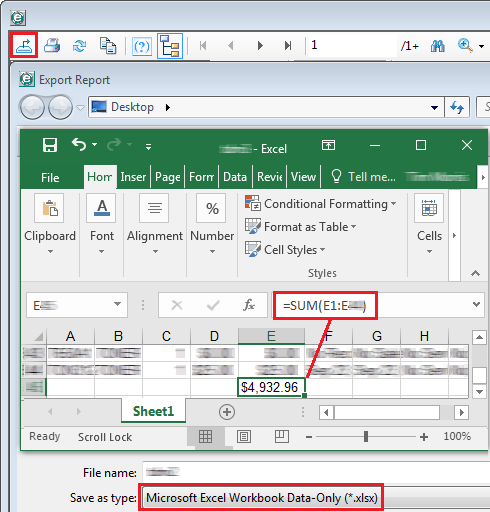

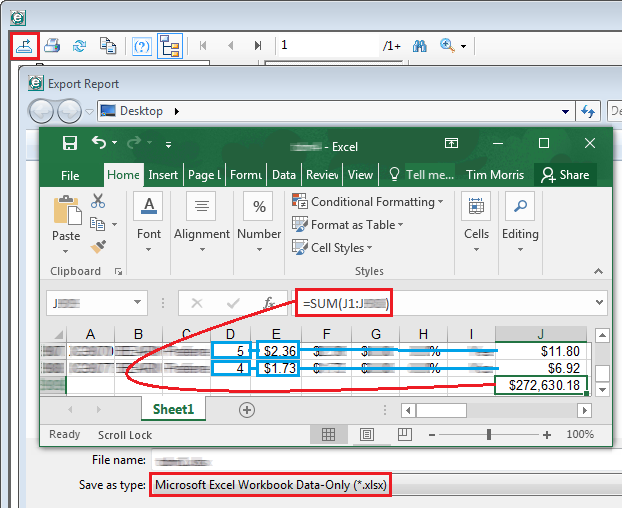

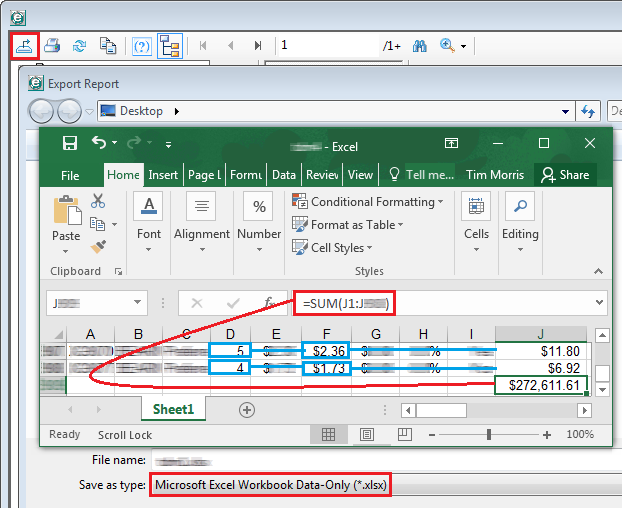

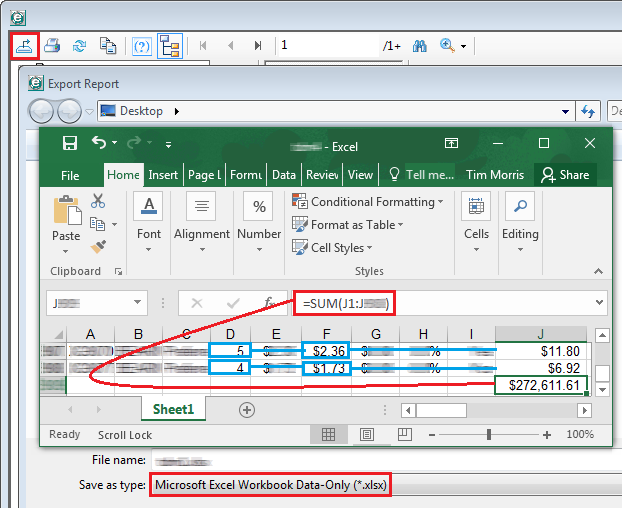

Example (based on Main Report image): Current Inventory Value = $272,612. Note: To see how the system arrives at this value ($272,612 in the sample image), see the Dealer Inventory Cost Details sub report. To get the exact monetary amount of the Current Inventory Value ($272,611.61), export the Dealer Inventory Cost Details sub report data to an Excel file, multiply the Quantity column (Column D) by the Average Cost column (Column F) and store the results in Column J, and then sum Column J.

|

|

|

The system-projected average cost of the inventory you should have on hand based on the usage of the items as determined by your Define Parts and Define Supplies parameters on service calls, sales orders, and production work orders over the Date Range you specified for the report multiplied by a hard-coded value of 4.04 (optimized for a three-month, or quarterly, Date Range).

Calculation: Target Inventory Value = (Total Parts Usage Average Cost + Total Supply Usage Average Cost) * 4.04

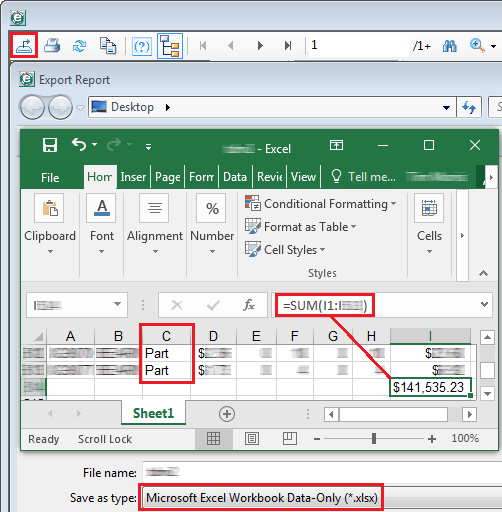

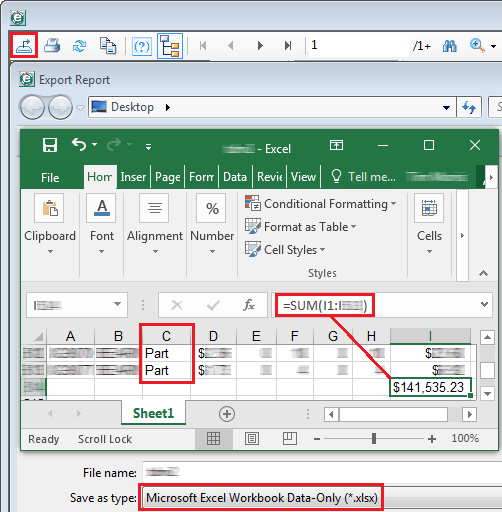

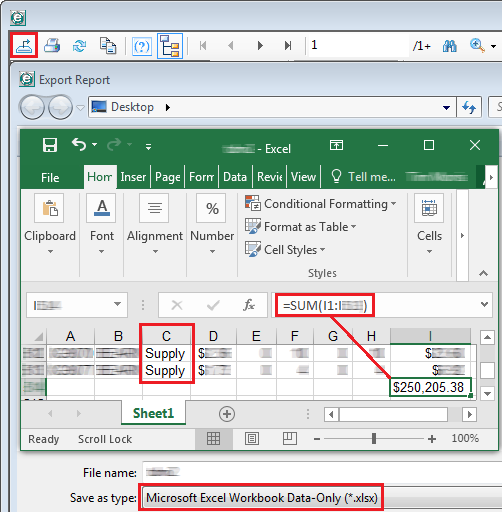

Example (based on Main Report image): Target Inventory Value = ($141,535.23 Total Parts Usage Average Cost + $250,205.38 Total Supply Usage Average Cost) * 4.04 = $1,582,632 (rounded to nearest integer) Note: To see how the system arrives at the Total Parts Usage Average Cost and Total Supply Usage Average Cost, see the Inventory Usage table on Report Page 3 and/or the Inventory Usage Details sub report.

|

|

|

The system-projected average cost of surplus inventory or inventory shortage based on subtracting the system projected Target Inventory Value from your Current Inventory Value.

Calculation: Excess/Shortfall = Current Inventory Value - Target Inventory Value

Example (based on Main Report image): Excess/Shortfall = $272,612 Current Inventory Value - $1,582,632 Target Inventory Value = ($1,310,020) |

|

|

Total average cost value of items included in the report based on your Define Parts and Define Supplies parameters that were used on service calls, sales orders, and production work orders divided by 3, then divided by the current inventory value, and then multiplied by 12.

Calculation: Current Inventory Turns = ((Total Average Cost of Items Included in Report that Were Used During Report Date Range on Service Calls, Sales Orders, and/or Production Work Order / 3) / Current Inventory Value Based on Average Cost) * 12

Example (based on Main Report image): Current Inventory Turns = (($391,740.61 Total Average Cost of Items Included in Report that Were Used During Report Date Range on Service Calls, Sales Orders, and/or Production Work Order / 3) / 272,611.61 Current Inventory Value) * 12 = 5.7 (rounded to one decimal position) Note: To see how the system arrives at the Total Average Cost Amount, see the Inventory Usage table on Report Page 3 and/or the Inventory Usage Details sub report. This value is the sum of the Parts Usage ($141,535.23) and Supply Usage ($250,205.38) amounts, which equals $391,740.61. To see how the system arrives at the Current Inventory Value Based on Average Cost ($272,611.61), see the Dealer Inventory Cost Details sub report.

|

|

|

The system-calculated number of inventory turns based on dividing the Target inventory Value by 3 and then dividing that amount by the Active Inventory Value. The Active Inventory Value is the total item average cost minus the dead inventory value. Calculation: Active Inventory Value = Current Inventory Value Based on Average Cost - Dead Inventory Value Based on Average Cost Turns Calculated on Active Inventory = (Target inventory Value / 3) / Active Inventory Value

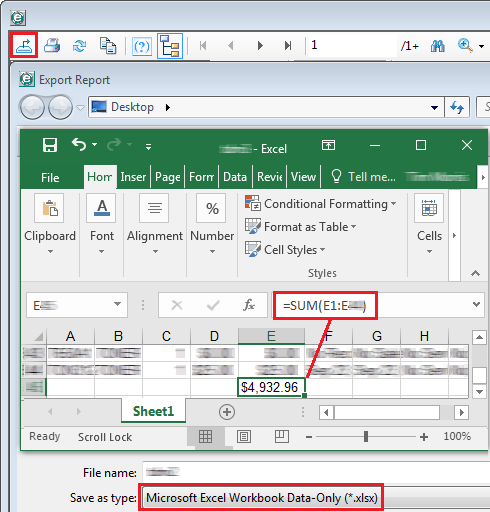

Example (based on Main Report image): Active Inventory Value = $272,611.61 Current Inventory Value Based on Average Cost - $4,932.96 Dead Inventory Value Based on Average Cost = $267,678.85 Turns Calculated on Active Inventory = ($1,582,632 Target inventory Value / 3) / $267,678.85 Active Inventory Value = 2.0 (1.98 rounded to 1 decimal position) Note: To see how the system arrives at the Dead Inventory Value ($4,932.96) to subtract from the Current Inventory Value ($272,611.61) to calculate the Active Inventory Value ($267,678.85), see the Dead Inventory (Zero Inventory Turn) Details sub report.

|

|

|

Current Inventory Purchase and Usage Metrics |

|

|

The total parts purchases for items included in the report based on your Define Parts parameter as received on PO Receipts during the Date Range you specified for the report divided by 3. Note: This calculation will only be accurate if you use a three-month Date Range.

Calculation: Monthly Average Parts Purchases = Total Parts Purchases Received on PO Receipts during Date Range / 3

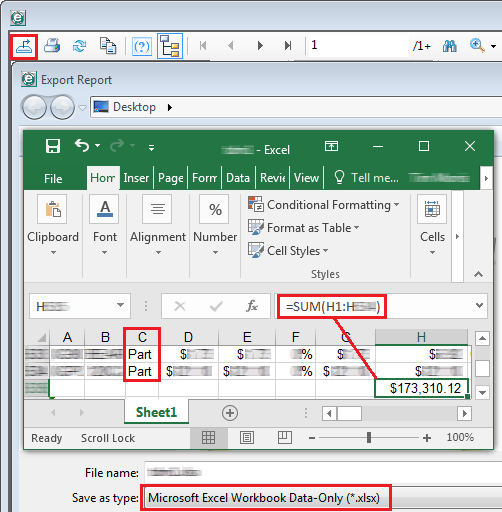

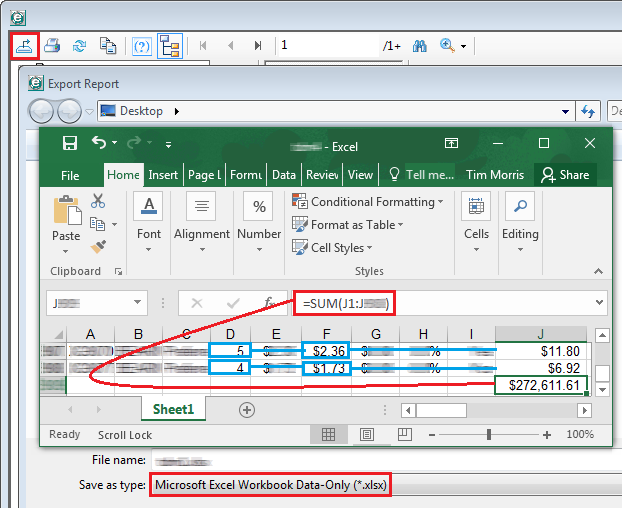

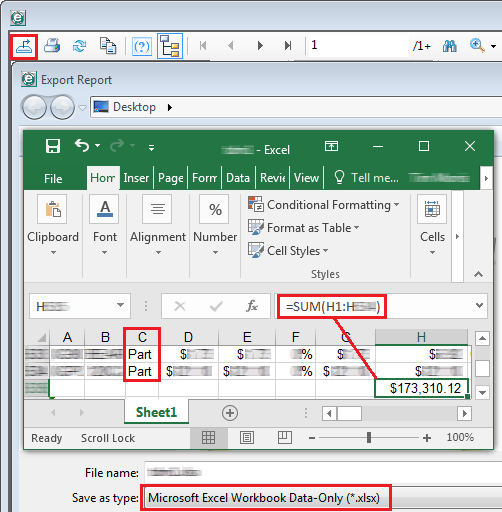

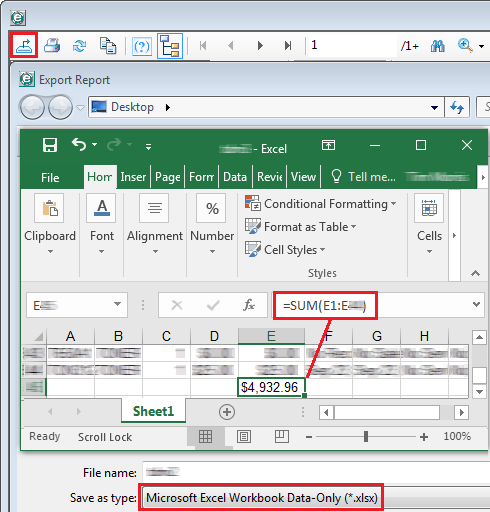

Example (based on Main Report image): Monthly Average Parts Purchases = $173,310.12 Total Parts Purchases Received on PO Receipts during Date Range / 3 = $57,770 (rounded to nearest integer) Note: To see the PO Receipt details on which this number is based, see the Inventory Purchased Details (Item Level) sub report. To get the exact monetary amount of parts purchased, export the Inventory Purchased Details (Item Level) sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column H) for the Part rows.

|

|

|

The total parts used on service calls, sales orders, and production work orders for items included in the report based on your Define Parts parameter during the Date Range you specified for the report divided by 3. Note: This calculation will only be accurate if you use a three-month Date Range.

Calculation: Monthly Average Parts Used = Total Parts Used on Service Calls, Sales Orders, and Production Work Orders during Date Range / 3

Example (based on Main Report image): Monthly Average Parts Used = $141,535.23 Total Parts Used on Service Calls, Sales Orders, and Production Work Orders during Date Range / 3 = $47,178 (rounded to nearest integer) Note: To see the usage details on which this number is based, see the Inventory Usage Details sub report. To get the exact monetary amount of parts purchased, export the Inventory Usage Details sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column I) for the Part rows.

|

|

|

The surplus inventory or inventory shortage based on subtracting the Monthly Average Parts Used from the Monthly Average Parts Purchases. Calculation: Excess/Shortfall (Parts) = Monthly Average Parts Purchases - Monthly Average Parts Used

Example (based on Main Report image): Excess/Shortfall (Parts) = $57,770.04 Monthly Average Parts Purchases - $47,178.41 Monthly Average Parts Used = $10,592 (rounded to nearest integer) Excess (Parts) |

|

|

The total supply purchases for items included in the report based on your Define Supplies parameter as received on PO Receipts during the Date Range you specified for the report divided by 3. Note: This calculation will only be accurate if you use a three-month Date Range.

Calculation: Monthly Average Supply Purchases = Total Supply Purchases Received on PO Receipts during Date Range / 3

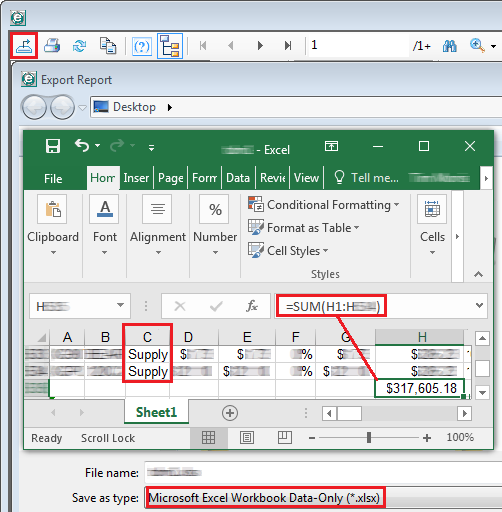

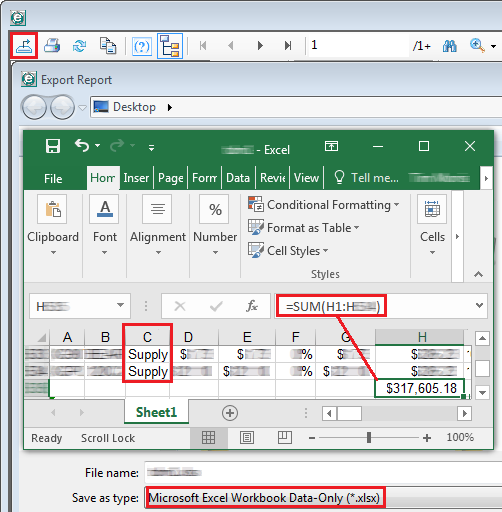

Example (based on Main Report image): Monthly Average Supply Purchases = $317,605.18 Total Supply Purchases Received on PO Receipts during Date Range / 3 = $105,868 (rounded to nearest integer) Note: To see the PO Receipt details on which this number is based, see the Inventory Purchased Details (Item Level) sub report. To get the exact monetary amount of supplies purchased, export the Inventory Purchased Details (Item Level) sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column H) for the Supply rows.

|

|

|

The total supplies used on service calls, sales orders, and production work orders for items included in the report based on your Define Supplies parameter during the Date Range you specified for the report divided by 3. Note: This calculation will only be accurate if you use a three-month Date Range.

Calculation: Monthly Average Supplies Used = Total Supplies Used on Service Calls, Sales Orders, and Production Work Orders during Date Range / 3

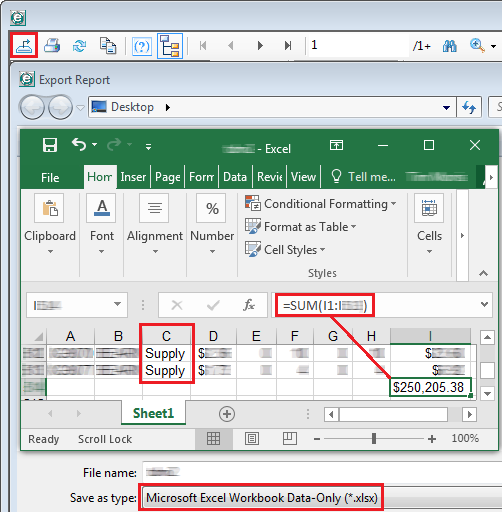

Example (based on Main Report image): Monthly Average Supplies Used = $250,205.38 Total Parts Used on Service Calls, Sales Orders, and Production Work Orders during Date Range / 3 = $83,402 (rounded to nearest integer) Note: To see the usage details on which this number is based, see the Inventory Usage Details sub report. To get the exact monetary amount of parts purchased, export the Inventory Usage Details sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column I) for the Supply rows.

|

|

|

The surplus inventory or inventory shortage based on subtracting the Monthly Average Supplies Used from the Monthly Average Supply Purchases. Calculation: Excess/Shortfall (Parts) = Monthly Average Supply Purchases - Monthly Average Supplies Used

Example (based on Main Report image): Excess/Shortfall (Supplies) = $105,868.39 Monthly Average Supply Purchases - $83,401.79 Monthly Average Supplies Used = $22,467 (rounded to nearest integer) Excess (Supplies) |

|

|

Dead Inventory Metrics |

|

|

The sum of the average costs of all items included in the report based on your Define Parts and Define Supplies parameters that have an on-hand quantity greater than 0 (zero) and that do not meet your Dead Inventory Use Months and Dead Inventory Receipt Months parameters for what constitutes dead inventory.

Calculation: Active Inventory Value = Sum(Average Cost of All Items Included in Report) - Sum(Average Cost of All Dead Inventory Items Included in Report)

Example (based on Main Report image using Dead Inventory Use Months = 18 months and Dead Inventory Receipt Months = 18 months): Active Inventory Value = $272,611.61 Average Cost of All Items Included in Report - $4,932.96 Average Cost of Dead Inventory Items Included in Report = $267,678.85 Note: To see how the system arrives at the Dead Inventory Value ($4,932.96) to subtract from the Current Inventory Value ($272,611.61) to calculate the Active Inventory Value ($267,678.85), see the Dead Inventory (Zero Inventory Turn) Details sub report.

|

|

|

The sum of the average costs of all items included in the report based on your Define Parts and Define Supplies parameters that meets your Dead Inventory Use Months and/or Dead Inventory Receipt Months parameters for what constitutes dead inventory.

Calculation: Dead Inventory Value = Sum(Average Cost of All Dead Inventory Items Included in Report)

Example (based on Main Report image using Dead Inventory Use Months = 18 months and Dead Inventory Receipt Months = 18 months): Dead Inventory Value = $4,932.96 Average Cost of Dead Inventory Items Included in Report Note: To see how the system arrives at the Dead Inventory Value ($4,932.96), see the Dead Inventory (Zero Inventory Turn) Details sub report. To get the exact monetary amount of the Dead Inventory Value, export the Dead Inventory (Zero Inventory Turn) Details sub report data to an Excel file and sum the Cost column (Column E).

|

|

|

The total inventory average cost (inventory quantity * average cost) of the items included in the Define Parts and Define Supplies parameters you specified for the report.

Calculation: Current Inventory Value = Sum(Inventory Quantity * Average Cost for Each Item Included in Report)

Example (based on Main Report image): Current Inventory Value = $272,612. Note: To see how the system arrives at this value ($272,612 in the sample image), see the Dealer Inventory Cost Details sub report. To get the exact monetary amount of the Current Inventory Value ($272,611.61), export the Dealer Inventory Cost Details sub report data to an Excel file, multiply the Quantity column (Column D) by the Average Cost column (Column F) and store the results in Column J, and then sum Column J.

|

|

|

The percentage of the inventory included in the report based on the Define Parts and Define Supplies parameters within the specified Date Range that meets your Dead Inventory Use Months and/or Dead Inventory Receipt Months parameters for what constitutes dead inventory. Calculation: % at Dead Level = (Dead Inventory Value / Current Inventory Value)*100

Example (based on Main Report image using Dead Inventory Use Months = 18 months and Dead Inventory Receipt Months = 18 months): % at Dead Level = ($4,932.96 Dead Inventory Value / $272,611.61 Current Inventory Value)*100 = 2% (rounded to no decimal positions) |

|

|

Rescheduled Service Call Metrics |

|

| The ratio of all calls marked incomplete during the specified Date Range to all calls completed during the specified Date Range.

Calculation: Current Reschedule % = (Incompleted Service Calls / Completed Service Calls)*100

Example (based on Main Report image): Current Reschedule % = (486 Incompleted Service Calls / 4,059 Completed Service Calls)*100 = 12% (rounded to no decimal positions) |

|

|

The ratio of all calls marked incomplete during the specified Date Range to all calls completed during the specified Date Range that you do not want to exceed. This value is the Target Reschedule Percentage parameter you specified for the report. The default value is 10%. |

|

|

The percentage of the difference between the Current Reschedule % and the Target Reschedule %. Calculation: Target Variance = ((Current Reschedule % - Target Reschedule %) / Current Reschedule %) * 100

Example (based on Main Report image and a Target Reschedule Percentage parameter value of 10%): Target Variance = ((0.119734 Current Reschedule % - 0.10 Target Reschedule %) /0.119734 Current Reschedule %) * 100 = 16% (rounded to no decimal positions) Note: A positive number indicates a variance above your target value, meaning the target percentage was not met. When the target percentage is not met, the system displays a

in the Incomplete Service Calls row of the Service Call Information table on Page 3 of this report and performs calculations to determine how much your company could save if you were able to reduce the Current Reschedule % to the Target Reschedule %. A negative number indicates a variance below your target value, meaning the target percentage was met. When the target percentage is met, the system displays a in the Incomplete Service Calls row of the Service Call Information table on Page 3 of this report and performs calculations to determine how much your company could save if you were able to reduce the Current Reschedule % to the Target Reschedule %. A negative number indicates a variance below your target value, meaning the target percentage was met. When the target percentage is met, the system displays a  in the Incomplete Service Calls row of the Service Call Information table on Page 3 of this report and sets to zero any calculations that would otherwise be used to determine how much your company could save by reducing your Current Reschedule % since this value is already below the Target Reschedule %. in the Incomplete Service Calls row of the Service Call Information table on Page 3 of this report and sets to zero any calculations that would otherwise be used to determine how much your company could save by reducing your Current Reschedule % since this value is already below the Target Reschedule %. |

|

|

The monthly cost of rescheduled service calls based on the average service call duration and the Rescheduled Hour Cost parameter you specified for the report. Calculation: Current R/S Cost @ [Rate] per Hour: ((Number of Incomplete Service Calls * Average Call Duration * Rescheduled Hour Cost) / Number of Months in Date Range

Example (based on Main Report image and a Rescheduled Hour Cost value of $65.00): Current R/S Cost @ $65.00 per Hour: ((486 Incomplete Service Calls * 1.810875 Hours Average Call Duration * $65.00 Rescheduled Hour Cost) / 3 Months in Date Range = $19,069 (rounded to nearest integer) |

|

|

The monthly cost of rescheduled service calls based on the average service call duration and the Rescheduled Hour Cost parameter you specified for the report that you do not want to exceed. Calculation: Target R/S Cost @ [Rate] per Hour = (((Number of Incomplete Service Calls * Average Call Duration) - R/S Hours Reduction) * Rescheduled Hour Cost) / Number of Months in Date Range

Example (based on Main Report image and a Rescheduled Hour Cost value of $65.00): Target R/S Cost @ $65.00 per Hour = (((486 Incomplete Service Calls * 1.810875 Hours Average Call Duration) - 95.906874 R/S Hours Reduction) * $65.00 Rescheduled Hour Cost) / 3 Months in Date Range = $16,991 (rounded to nearest integer) Note: See the R/S Hours Reduction section below to see how the R/S Hours Reduction amount was calculated.

Note: If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to $0.

|

|

|

The monthly cost difference of your technicians' customer and travel time between rescheduled service calls at your Current Reschedule % and your Target Reschedule %. Calculation: R/S Customer /Travel Cost Reduction = Current R/S Cost @ [Rate] per Hour - Target R/S Cost @ [Rate] per Hour

Example (based on Main Report image and a Rescheduled Hour Cost value of $65.00): R/S Customer /Travel Cost Reduction = $19,608.51375 Current R/S Cost @ $65.00 per Hour - $16,990.531458 Target R/S Cost @ $65.00 per Hour = $2,078 (rounded to nearest integer, and also displayed at the bottom of this column with two decimal positions—$2,077.98). Note: A value greater than zero indicates the monthly cost of your technicians' customer and travel time you could save per month if you could reduce your Current Reschedule % to your Target Reschedule %. If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to $0.00.

|

|

|

Labor Impact of Rescheduled Service Calls |

|

|

The total customer time plus the total travel time difference between the rescheduled calls at your Current Reschedule % and the rescheduled calls at your specified Target Reschedule Percentage.

Calculation: Potential Labor Hours to Recapture = Number of Incomplete Service Calls * ( ( ( Number of Incomplete Service Calls / Number of Closed Service Calls ) - Target Reschedule Percentage) / Target Reschedule Percentage)

Example (based on Main Report image): Potential Labor Hours to Recapture = 486 Incomplete Service Calls * ( ( ( 486 Incomplete Service Calls / 4,059 Closed Service Calls ) - .10 Target Reschedule Percentage) /.10 Target Reschedule Percentage) = 95.9 (rounded to one decimal position) Note: A value greater than zero indicates the number of technician hours your Current Reschedule % is above your Target Reschedule %. If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to 0.0.

|

|

|

The number of potential technicians you could save per month if you could reduce your Current Reschedule % to your Target Reschedule Percentage. The calculation is based on multiplying the number of labor hours you could recapture by the Monthly Technician Hours parameter you specified for the report.

Calculation: Potential Technicians (Monthly) = Potential Labor Hours to Recapture / Monthly Technician Hours

Example (based on Main Report image and a Monthly Technician Hours value of 140): Potential Technicians (Monthly) = 95.906874 Potential Labor Hours to Recapture / 140 Monthly Technician Hours = 0.7 (rounded to one decimal position) Note: A value greater than zero indicates the number of technicians you could save per month if you could reduce your Current Reschedule % to your Target Reschedule %. If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to 0.0.

|

|

|

Calculations and/or Comparison of Actual Values to Target Values |

|

|

Total average cost value of items included in the report based on your Define Parts and Define Supplies parameters that were used on service calls, sales orders, and production work orders divided by 3, then divided by the current inventory value, and then multiplied by 12.

Calculation: Current Inventory Turns = ((Total Average Cost of Items Included in Report that Were Used During Report Date Range on Service Calls, Sales Orders, and/or Production Work Order / 3) / Current Inventory Value Based on Average Cost) * 12

Example (based on Main Report image): Current Inventory Turns = (($391,740.61 Total Average Cost of Items Included in Report that Were Used During Report Date Range on Service Calls, Sales Orders, and/or Production Work Order / 3) / 272,611.61 Current Inventory Value) * 12 = 5.7 (rounded to one decimal position) Note: To see how the system arrives at the Total Average Cost Amount, see the Inventory Usage table on Report Page 3 and/or the Inventory Usage Details sub report. This value is the sum of the Parts Usage ($141,535.23) and Supply Usage ($250,205.38) amounts, which equals $391,740.61. To see how the system arrives at the Current Inventory Value Based on Average Cost ($272,611.61), see the Dealer Inventory Cost Details sub report.

|

|

|

The report's industry standard target number of inventory turns (i.e., 3.0). |

|

|

The percentage of the inventory included in the report based on the Define Parts and Define Supplies parameters within the specified Date Range that meets your Dead Inventory Use Months and/or Dead Inventory Receipt Months parameters for what constitutes dead inventory. Calculation: "Dead" Inventory % (Dealer) = (Dead Inventory Value / Current Inventory Value)*100

Example (based on Main Report image using Dead Inventory Use Months = 18 months and Dead Inventory Receipt Months = 18 months): "Dead" Inventory % (Dealer) = ($4,932.96 Dead Inventory Value / $272,611.61 Current Inventory Value)*100 = 1.8% (rounded to one decimal positions) |

|

|

The report's industry standard target percentage of inventory that constitutes dead inventory (i.e., 10%). |

|

|

The ratio of all calls marked incomplete during the specified Date Range to all calls completed during the specified Date Range. Calculation: Incomplete Call % (Dealer) = (Incompleted Service Calls / Completed Service Calls)*100

Example (based on Main Report image): Incomplete Call % (Dealer) = (486 Incompleted Service Calls / 4,059 Completed Service Calls)*100 = 12.0% (rounded to one decimal position) |

|

|

The ratio of all calls marked incomplete during the specified Date Range to all calls completed during the specified Date Range that you do not want to exceed. This value is the Target Reschedule Percentage parameter you specified for the report. The default value is 10.0%. |

|

|

The percentage of the difference between the Current Reschedule % and the Target Reschedule %. Calculation: Excess R/S Percentage Above Target (Dealer) = ((Current Reschedule % -Target Reschedule %) / Current Reschedule %) * 100

Example (based on Main Report image and a Target Reschedule Percentage parameter value of 10%): Excess R/S Percentage Above Target (Dealer) = ((0.119734 Current Reschedule % - 0.10 Target Reschedule %) /0.119734 Current Reschedule %) * 100 = 16.5% (rounded to one decimal position) |

|

|

The total Labor Hours plus the total Overtime Hours minus the total Interrupt Hours plus the Travel Hours spent on all service calls that were closed during the report's Date Range.

Calculation: Total Cust & Travel Hours (Dealer) = SUM(Labor Hours) + SUM(Overtime Hours) - SUM(Interrupt Hours) + SUM(Travel Hours)

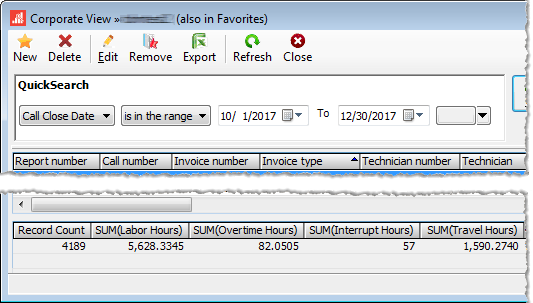

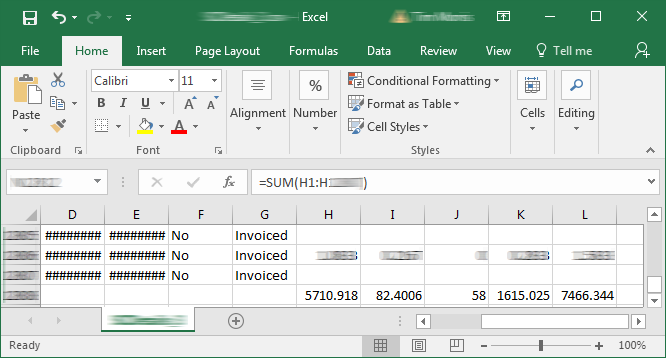

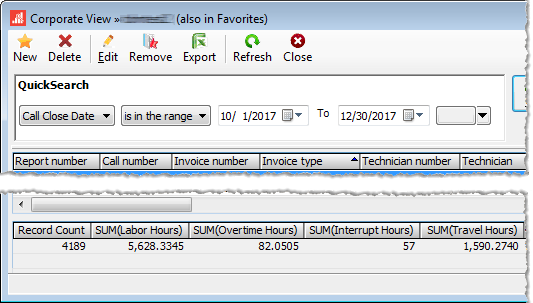

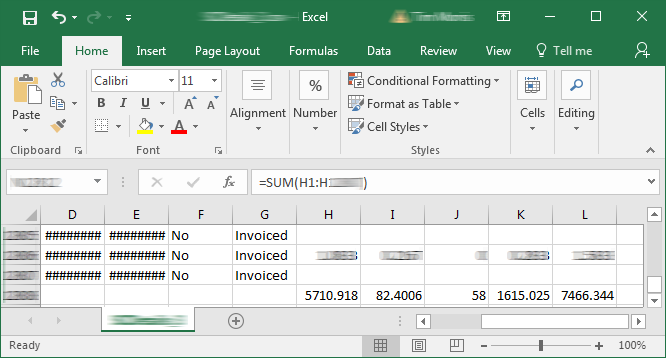

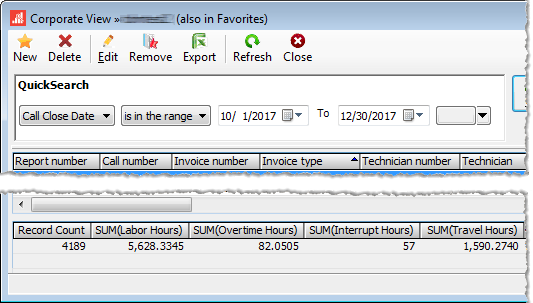

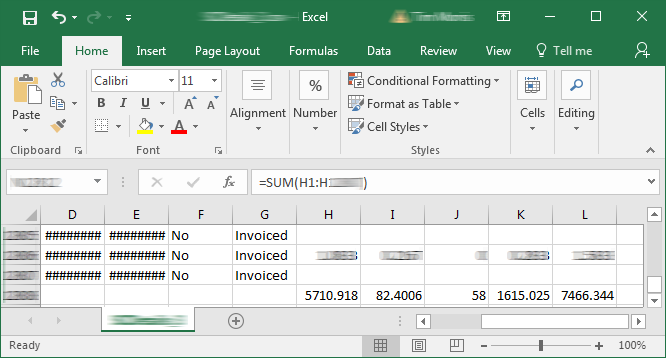

Example (based on Main Report image): Total Cust & Travel Hours (Dealer) = 5,710.9178 Labor Hours + 82.4006 Overtime Hours - 58 Interrupt Hours + 1,615.0241 Hours = 7,350.3 Hours (rounded to one decimal position) Note: While you can export the data from the Service Call Details sub report, the main report lists this data more precisely (an extra decimal point of precision) than the export file does. Due to rounding, the exported data may not match the report's data exactly. If you customize the Service Calls (Invoiced) Labor e-view to include the Interrupt Hours column, the Call Close Date filter, and the SUM Interrupt Hours function, you can perform a QuickSearch using the Call Close Date filter, selecting is in the range, and entering a date range equal to your report's Date Range, subtracting one day from the last day of the date range.

If you choose to export the data from the Service Call Details sub report, you will need to manipulate the data to get it into a useful format for summing the hourly values (e.g., export the data as a .csv file, delete the leading commas at the beginning of each row, delete the hour labels such as "Total Labor Hours: " in each cell containing hourly values, and then sum the values in each column containing hourly values). In the sample image below, Columns H-L represent the Labor, Overtime, Interrupt, Travel, and Total Hours, respectively.

|

|

|

The total Labor Hours plus the total Overtime Hours minus the total Interrupt Hours plus the Travel Hours spent on all service calls that were closed during the report's Date Range multiplied by the Rescheduled Hour Cost parameter you specified for the report.

Calculation: Hours Cost @ [Rate] (Dealer) = Total Cust & Travel Hours (Dealer) * Rescheduled Hour Cost

Example (based on Main Report image): Hours Cost @ $65.00 (Dealer) = 7,350.3425 Total Cust & Travel Hours (Dealer) * $65.00 = $477,772 (rounded to the nearest integer) |

|

|

The three-month number of rescheduled service call hours. Calculation: Current R/S Hours (Dealer) = Number of Incomplete Service Calls * Average Call Duration

Example (based on Main Report image): Current R/S Hours (Dealer) = 486 Incomplete Service Calls * 1.810875 Average Call Duration = 880.1 Hours (rounded to one decimal position) |

|

|

The three-month target number of rescheduled service call hours. Calculation: Current R/S Hours (Target) = (Number of Incomplete Service Calls * Average Call Duration) - R/S Hours Reduction

Example (based on Main Report image): Current R/S Hours (Target) = (486 Incomplete Service Calls * 1.810875 Hours Average Call Duration) - 95.906874 R/S Hours Reduction = 784.2 Hours (rounded to one decimal position) Note: See the R/S Hours Reduction section to see how the R/S Hours Reduction amount was calculated.

Note: If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to 0.0.

|

|

|

The three-month cost of rescheduled service calls based on the average service call duration and the Rescheduled Hour Cost parameter you specified for the report. Calculation: R/S Cost @ [Rate] per Hour = Number of Incomplete Service Calls * Average Call Duration * Rescheduled Hour Cost

Example (based on Main Report image and a Rescheduled Hour Cost value of $65.00): R/S Cost @ $65.00 per Hour = 486 Incomplete Service Calls * 1.810875 Hours Average Call Duration * $65.00 Rescheduled Hour Cost = $57,206 (rounded to nearest integer) Note: If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to $0.

|

|

|

The three-month cost of rescheduled service calls based on the average service call duration and the Rescheduled Hour Cost parameter you specified for the report that you do not want to exceed. Calculation: Target R/S Cost @ [Rate] per Hour = (((Number of Incomplete Service Calls * Average Call Duration) - R/S Hours Reduction) * Rescheduled Hour Cost)

Example (based on Main Report image and a Rescheduled Hour Cost value of $65.00): Target R/S Cost @ $65.00 per Hour = (((486 Incomplete Service Calls * 1.810875 Hours Average Call Duration) - 95.906874 R/S Hours Reduction) * $65.00 Rescheduled Hour Cost) = $50,972 (rounded to nearest integer) Note: See the R/S Hours Reduction section to see how the R/S Hours Reduction amount was calculated.

Note: If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to 0.0.

|

|

|

The total customer time plus the total travel time difference between the rescheduled calls at your Current Reschedule % and the rescheduled calls at your specified Target Reschedule Percentage.

Calculation: Projected Reduction in R/S Hours (Target) = Number of Incomplete Service Calls * ( ( ( Number of Incomplete Service Calls / Number of Closed Service Calls ) - Target Reschedule Percentage) / Target Reschedule Percentage)

Example (based on Main Report image): Projected Reduction in R/S Hours (Target) = 486 Incomplete Service Calls * ( ( ( 486 Incomplete Service calls / 4,059 Closed Service Calls ) - .10 Target Reschedule Percentage) /.10 Target Reschedule Percentage) = 95.9 Hours (rounded to one decimal position) Note: A number greater than zero indicates the number of technician hours your Current Reschedule % is above your Target Reschedule Percentage. If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to $0.

|

|

|

The cost of the total customer time plus the total travel time difference between the rescheduled calls at your Current Reschedule % and the rescheduled calls at your specified Target Reschedule Percentage.

Calculation: Projected Reduction in R/S Hour Costs (Target) = Projected Reduction in Reschedule Call Hours * Rescheduled Hour Cost

Example (based on Main Report image and a Rescheduled Hour Cost value of $65.00): Projected Reduction in R/S Hour Costs (Target) = 95.906874 Projected Reduction in Reschedule Call Hours * $65.00 Rescheduled Hour Cost = $6,234 (rounded to nearest integer) |

|

|

The total customer time plus the travel time divided by the total number of service calls completed during the Date Range you specified for the report. Calculation: Average Call Duration (Dealer) = (Total Customer Time * Total Travel Time) / Number of Completed Service Calls in Date Range

Example (based on Main Report image): Average Call Duration (Dealer) = (5,735.32 Total Customer Time + 1,615.02 Total Travel Time) / 4,059 Completed Service Calls = 1.8 (rounded to one decimal position) |

|

|

Dealer Inventory Cost |

|

|

The sample report received the |

|

|

The total inventory current cost (inventory quantity * current cost) of the items included in the Define Parts and Define Supplies parameters you specified for the report. Note: The current cost used in this report is not the current cost of the item as recorded in e-automate. For more information, see the Current Cost Origin listing in this table.

Calculation: Inventory Current Cost = Sum(Inventory Quantity * Current Cost for Each Item Included in Report)

Example (based on Main Report image): Inventory Average Cost = $272,630.18 Note: To see how the system arrives at this value ($272,612 in the sample image), see the Dealer Inventory Cost Details sub report. To get the exact monetary amount of the Average Inventory Cost ($272,630.18), export the Dealer Inventory Cost Details sub report data to an Excel file, multiply the Quantity column (Column D) by the Current Cost column (Column E) and store the results in Column J, and then sum Column J.

|

|

|

The sample report received the |

|

|

The total inventory average cost (inventory quantity * average cost) of the items included in the Define Parts and Define Supplies parameters you specified for the report.

Calculation: Inventory Average Cost = Sum(Inventory Quantity * Average Cost for Each Item Included in Report)

Example (based on Main Report image): Inventory Average Cost = $272,611.61 Note: To see how the system arrives at this value ($272,611.61 in the sample image), see the Dealer Inventory Cost Details sub report. To get the exact monetary amount of the Average Inventory Cost ($272,611.61), export the Dealer Inventory Cost Details sub report data to an Excel file, multiply the Quantity column (Column D) by the Average Cost column (Column F) and store the results in Column J, and then sum Column J.

|

|

|

Inventory Purchased |

|

|

The sample report received the |

|

|

The total parts purchases for items included in the report based on your Define Parts parameter as received on PO Receipts during the Date Range you specified for the report. Calculation: Parts Purchases (Value) = SUM(Parts Purchases Received on PO Receipts during Date Range)

Example (based on Main Report image): Parts Purchases (Value) = $173,310.12 Note: To see the PO Receipt details on which this number is based, see the Inventory Purchased Details (Item Level) sub report. To get the exact monetary amount of parts purchased, export the Inventory Purchased Details (Item Level) sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column H) for the Part rows.

|

|

|

The sample report received the |

|

|

The total supply purchases for items included in the report based on your Define Supplies parameter as received on PO Receipts during the Date Range you specified for the report. Calculation: Supplies Purchased (Value) = SUM(Supply Purchases Received on PO Receipts during Date Range)

Example (based on Main Report image): Supplies Purchased (Value) = $317,605.18 Note: To see the PO Receipt details on which this number is based, see the Inventory Purchased Details (Item Level) sub report. To get the exact monetary amount of supplies purchased, export the Inventory Purchased Details (Item Level) sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column H) for the Supply rows.

|

|

|

Zero Turn Inventory |

|

|

The sample report received the |

|

|

The sum of the average costs of all items included in the report based on your Define Parts and Define Supplies parameters that do not meet your Dead Inventory Use Months and/or Dead Inventory Receipt Months parameters for what constitutes dead inventory.

Calculation: Active Inventory Value = Inventory Average Cost of All Items Included in Report - Average Cost of Dead Inventory Items Included in Report

Example (based on Main Report image): Active Inventory Value = $272,611.61 Inventory Average Cost of All Items Included in Report - $4,932.96 Average Cost of Dead Inventory Items Included in Report = $267,678.65 Note: To see how the system calculates Dead Inventory Value, see the "Dead" Inventory Value

(Value) section below. |

|

|

The sample report received the |

|

|

The sum of the average costs of all items included in the report based on your Define Parts and Define Supplies parameters that meets your Dead Inventory Use Months and/or Dead Inventory Receipt Months parameters for what constitutes dead inventory.

Calculation: Dead Inventory Value = Sum(Average Cost of All Dead Inventory Items Included in Report)

Example (based on Main Report image using Dead Inventory Use Months = 18 months and Dead Inventory Receipt Months = 18 months): Dead Inventory Value = $4,932.96 Average Cost of Dead Inventory Items Included in Report Note: To see how the system arrives at the Dead Inventory Value ($4,932.96), see the Dead Inventory (Zero Inventory Turn) Details sub report. To get the exact monetary amount of the Dead Inventory Value, export the Dead Inventory (Zero Inventory Turn) Details sub report data to an Excel file and sum the Cost column (Column E).

|

|

|

Inventory Usage |

|

|

|

|

|

The total parts used on service calls, sales orders, and production work orders for items included in the report based on your Define Parts parameter during the Date Range you specified for the report. Calculation: Parts Usage (Value) = SUM( Parts Used on Service Calls, Sales Orders, and Production Work Orders during Date Range)

Example (based on Main Report image): Parts Usage (Value) = $141,535.23 Note: To see the usage details on which this number is based, see the Inventory Usage Details sub report. To get the exact monetary amount of parts purchased, export the Inventory Usage Details sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column I) for the Part rows.

|

|

|

|

|

|

The total supplies used on service calls, sales orders, and production work orders for items included in the report based on your Define Supplies parameter during the Date Range you specified for the report. Calculation: Supply Usage (Value) = SUM(Supplies Used on Service Calls, Sales Orders, and Production Work Orders during Date Range)

Example (based on Main Report image): Supply Usage (Value) = $250,205.38 Note: To see the usage details on which this number is based, see the Inventory Usage Details sub report. To get the exact monetary amount of parts purchased, export the Inventory Usage Details sub report data to an Excel file, sort the rows by the Part/Supply column (Column C), and sum the Cost column (Column I) for the Supply rows.

|

|

|

Service Call Information |

|

|

|

|

|

The total number of service calls marked complete during the Date Range you specified for the report. The example image shows 4,059 calls were marked complete during the October 1 to December 31 report date range. Note: For a complete list of these service calls, see the Service Call Details sub report.

|

|

|

The sample report received the |

|

|

The total number of service calls marked incomplete during the Date Range you specified for the report. The example image shows 486 calls were marked incomplete during the October 1 to December 31 report date range. Note: For details, see the Service Call Details sub report.

|

|

|

|

|

|

The total Labor Hours plus the total Overtime Hours minus the total Interrupt Hours spent on all service calls that were closed during the report's Date Range.

Calculation: Customer Hours = SUM(Labor Hours) + SUM(Overtime Hours) - SUM(Interrupt Hours)

Example (based on Main Report image): Customer Hours = 5,710.9178 Labor Hours + 82.4006 Overtime Hours - 58 Interrupt Hours = 5,735.32 Hours (rounded to two decimal positions) Note: While you can export the data from the Service Call Details sub report, the main report lists this data more precisely (an extra decimal point of precision) than the export file does. Due to rounding, the exported data may not match the report's data exactly. If you customize the Service Calls (Invoiced) Labor e-view to include the Interrupt Hours column, the Call Close Date filter, and the SUM Interrupt Hours function, you can perform a QuickSearch using the Call Close Date filter, selecting is in the range, and entering a date range equal to your report's Date Range, subtracting one day from the last day of the date range.

If you choose to export the data from the Service Call Details sub report, you will need to manipulate the data to get it into a useful format for summing the hourly values (e.g., export the data as a .csv file, delete the leading commas at the beginning of each row, delete the hour labels such as "Total Labor Hours: " in each cell containing hourly values, and then sum the values in each column containing hourly values). In the sample image below, Columns H-L represent the Labor, Overtime, Interrupt, Travel, and Total Hours, respectively.

|

|

|

|

|

|

The total Travel Hours spent on all service calls that were closed during the report's Date Range.

Calculation: Travel Hours = SUM(Travel Hours)

Example (based on Main Report image): Travel Hours = 1,615.02 Hours (rounded to two decimal positions) Note: While you can export the data from the Service Call Details sub report (where values are rounded to four decimal positions), the values in the main report are calculated using additional decimal positions. Due to rounding, the exported data may not match the report's data exactly. If you customize the Service Calls (Invoiced) Labor e-view to include the Call Close Date filter, you can perform a QuickSearch using the Call Close Date filter, selecting is in the range, and entering a date range equal to your report's Date Range.

If you choose to export the data from the Service Call Details sub report, you will need to manipulate the data to get it into a useful format for summing the hourly values (e.g., export the data as a .csv file, delete the leading commas at the beginning of each row, delete the hour labels such as "Total Labor Hours: " in each cell containing hourly values, and then sum the values in each column containing hourly values). In the sample image below, Columns H-L represent the Labor, Overtime, Interrupt, Travel, and Total Hours, respectively.

|

|

|

Summary Information |

|

|

The percentage of rescheduled service calls above the Target Reschedule Percentage you specified for the report. Calculation: Excess R/S Call Percentage = Incomplete Service Calls / (Total Service Calls - Target Reschedule Percentage) * 100

Example (based on Main Report image and a Target Reschedule Percentage of 10%): Excess R/S Call Percentage = ((486 Incomplete Service Calls / 4,059 Total Service Calls) - .10 Target Reschedule Percentage) * 100 = 2% (rounded to no decimal positions) |

|

|

The total customer time plus the travel time divided by the total number of service calls completed during the Date Range you specified for the report. Calculation: Average Call Duration = (Total Customer Time * Total Travel Time) / Number of Completed Service Calls in Date Range

Example (based on Main Report image): Average Call Duration = (5,735.32 Total Customer Time + 1,615.02 Total Travel Time) / 4,059 Completed Service Calls = 1.81 (rounded to two decimal positions) |

|

|

Additional Information |

|

|

The total customer time plus the total travel time difference between the rescheduled calls at your Current Reschedule % and the rescheduled calls at your specified Target Reschedule Percentage.

Calculation: R/S Hours Reduction = Number of Incomplete Service Calls * ( ( ( Number of Incomplete Service Calls / Number of Closed Service Calls ) - Target Reschedule Percentage) / Target Reschedule Percentage)

Example (based on Main Report image): R/S Hours Reduction = 486 Incomplete Service Calls * ( ( ( 486 Incomplete Service calls / 4,059 Closed Service Calls ) - .10 Target Reschedule Percentage) /.10 Target Reschedule Percentage) = 95.9 (rounded to one decimal position) Note: A number greater than zero indicates the number of technician hours your Current Reschedule % is above your Target Reschedule Percentage. If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to 0.0.

|

|

|

The rescheduled service call hours at your Target Reschedule Percentage.

Calculation: R/S Hours @ [Rate] % R/S = (Number of Incomplete Service Calls * Average Call Duration) - R/S Hours Reduction

Example (based on Main Report image): R/S Hours @ [Rate] % R/S = (486 Incomplete Service Calls * 1.810875 Hours Average Call Duration) - 95.906874 R/S Hours Reduction = 784.2 (rounded to one decimal position) Note: See the R/S Hours Reduction section to see how the R/S Hours Reduction amount was calculated.

Note: If your Target Variance is negative (indicating the current rescheduled call percentage is below the target rescheduled call percentage you specified for the report), the system will set this amount to 0.0.

|

|

Dealer Inventory Cost Details Sub ReportDealer Inventory Cost Details Sub Report

Following is a sample Dealer Inventory Scorecard Report's Dealer Inventory Cost Details sub report.

The following table explains how the data in the Dealer Inventory Cost Details sub report is used to calculate the amounts displayed in the main report.

Inventory Purchased Details Sub ReportsInventory Purchased Details Sub Reports

Inventory Purchased Details (Item-level) Sub ReportInventory Purchased Details (Item-level) Sub Report

Following is a sample Dealer Inventory Scorecard Report's Inventory Purchased Details (Item-level) sub report.

The following table explains how the data in the Inventory Purchased Details (Item-level) sub report is used to calculate amounts displayed on the main report.

|

Report Label |

Description and/or Calculation |

|

Summary Table |

|

|

The number of distinct stocked inventory item numbers included in the Define Parts parameter you specified for the report that were included on Purchase Order Receipts during the report's Date Range (in the sample report, 534 Part items). The Inventory Purchased Details (Item-level) sub report includes one row per part, and items (Parts and Supplies) are sequenced by Item Number. |

|

|

The number of stocked inventory items included in the Define Parts parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is equal to 0 (zero) percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. = 0% (Parts Count) = Sum(Items Where Supply or Part column = Part and % of Diff. column = 0%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. = 0% (Parts Count) = Sum(Items P001 and 514 other Items not shown in the sample image) = 515

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. = 0% (Parts Count) to the Total Parts Purchases.

Calculation: % of Diff. = 0% (Parts Percentage) = (% of Diff. = 0% (Parts Count) / Total Parts Purchases) * 100

Example (based on Dealer Inventory Cost Details image): % of Diff. = 0% (Parts Percentage) = (515 % of Diff. = 0% (Parts Count) / 534 Total Parts Purchases) * 100 = 96% (rounded to no decimal positions) |

|

|

The number of stocked inventory items included in the Define Parts parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is greater than 0 (zero) percent and less than 25 percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. > 0% and < 25% (Parts Count) = Sum(Items Where Supply or Part column = Part and % of Diff. column > 0% and < 25%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. > 0% and < 25% (Parts Count) = Sum(Item P002 and 2 other Items not shown in the sample image) = 3

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. > 0% and < 25% (Parts Count) to the Total Parts Purchases.

Calculation: % of Diff. > 0% and < 25% (Parts Percentage) = (% of Diff. > 0% and < 25% (Parts Count) / Total Parts Purchases) * 100

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. > 0% and < 25% (Parts Percentage) = (3 % of Diff. > 0% and < 25% (Parts Count) / 534 Total Parts Purchases) * 100 = 1% (rounded to no decimal positions) |

|

|

The number of stocked inventory items included in the Define Parts parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is greater than or equal to 25 percent and less than 50 percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. >= 25% and < 50% (Parts Count) = Sum(Items Where Supply or Part column = Part and % of Diff. column >= 25% and < 50%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 25% and < 50% (Parts Count) = Sum(3 Items not shown in the sample image) = 3

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. >= 25% and < 50% (Parts Count) to the Total Parts Purchases.

Calculation: % of Diff. >= 25% and < 50% (Parts Percentage) = (% of Diff. >= 25% and < 50% (Parts Count) / Total Parts Purchases) * 100

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 25% and < 50% (Parts Percentage) = (3 % of Diff. >= 25% and < 50% (Parts Count) / 534 Total Parts Purchases) * 100 = 1% (rounded to no decimal positions) |

|

|

The number of stocked inventory items included in the Define Parts parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is greater than or equal to 50 percent and less than 100 percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. >= 50% and < 100% (Parts Count) = Sum(Items Where Supply or Part column = Part and % of Diff. column >= 50% and < 100%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 50% and < 100% (Parts Count) = Sum(0 Items) = 0

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. >= 25% and < 50% (Parts Count) to the Total Parts Purchases.

Calculation: % of Diff. >= 50% and < 100% (Parts Percentage) = (% of Diff. >= 50% and < 100% (Parts Count) / Total Parts Purchases) * 100

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 50% and < 100% (Parts Percentage) = (0 % of Diff. >= 50% and < 100% (Parts Count) / 534 Total Parts Purchases) * 100 = 0% |

|

|

The number of stocked inventory items included in the Define Parts parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is greater than or equal to 100 percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. >= 100% (Parts Count) = Sum(Items Where Supply or Part column = Part and % of Diff. column >= 25% and < 50%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 100% (Parts Count) = Sum(13 Items not shown in the sample image) = 13

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. >= 100% (Parts Count) to the Total Parts Purchases.

Calculation: % of Diff. >= 100% (Parts Percentage) = (% of Diff. >= 100% (Parts Count) / Total Parts Purchases) * 100

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 100% (Parts Percentage) = (13 % of Diff. >= 100% (Parts Count) / 534 Total Parts Purchases) * 100 = 2% (rounded to no decimal positions)

Note: To receive a Green Check (

) on Parts Purchases on Page 3 of the main Dealer Inventory Scorecard report, this percentage must be 0%. Since it is 2% for this sample report, the sample report received a red X ( ) on Parts Purchases on Page 3 of the main Dealer Inventory Scorecard report, this percentage must be 0%. Since it is 2% for this sample report, the sample report received a red X ( ) for Parts Purchases. ) for Parts Purchases. |

|

|

The number of distinct stocked inventory item numbers included in the Define Supplies parameter you specified for the report that were included on Purchase Order Receipts during the report's Date Range (in the sample report, 321 Supply items). The Inventory Purchased Details (Item-level) sub report includes one row per supply, and items (Parts and Supplies) are sequenced by Item Number. |

|

|

The number of stocked inventory items included in the Define Supplies parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is equal to 0 (zero) percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. = 0% (Supplies Count) = Sum(Items Where Supply or Part column = Supply and % of Diff. column = 0%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. = 0% (Supplies Count) = Sum(Items S003, S004, and 313 other Items not shown in the sample image) = 315

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. = 0% (Supplies Count) to the Total Supplies Purchases.

Calculation: % of Diff. = 0% (Supplies Percentage) = (% of Diff. = 0% (Supplies Count) / Total Supplies Purchases) * 100

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. = 0% (Supplies Percentage) = (315 % of Diff. = 0% (Supplies Count) / 321 Total Supplies Purchases) * 100 = 98% (rounded to no decimal positions) |

|

|

The number of stocked inventory items included in the Define Supplies parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is greater than 0 (zero) percent and less than 25 percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. > 0% and < 25% (Supplies Count) = Sum(Items Where Supply or Part column = Supply and % of Diff. column > 0% and < 25%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. > 0% and < 25% (Supplies Count) = Sum(5 Items not shown in the sample image) = 5

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. > 0% and < 25% (Supplies Count) to the Total Supplies Purchases.

Calculation: % of Diff. > 0% and < 25% (Supplies Percentage) = (% of Diff. > 0% and < 25% (Supplies Count) / Total Supplies Purchases) * 100

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. > 0% and < 25% (Supplies Percentage) = (5 % of Diff. > 0% and < 25% (Supplies Count) / 321 Total Supplies Purchases) * 100 = 2% (rounded to no decimal positions) |

|

|

The number of stocked inventory items included in the Define Supplies parameter you specified for the report for which the difference between the Maximum Purchase Price and the Minimum Purchase Price of an item on Purchase Order Receipts during the report's Date Range is greater than or equal to 25 percent and less than 50 percent of the Average Purchase Price on Purchase Order Receipts during the report's Date Range.

Calculation: % of Diff. >= 25% and < 50% (Parts Count) = Sum(Items Where Supply or Part column = Supply and % of Diff. column >= 25% and < 50%)

Example (based on Inventory Purchased Details (Item-level) sub report image): % of Diff. >= 25% and < 50% (Parts Count) = Sum(0 Items) = 0

Note: To see how the % of Diff. is calculated for each item, see the Dealer Inventory Scorecard Report's Inventory Purchased Details (Transaction-level) sub report.

|

|

|

The ratio of the % of Diff. >= 25% and < 50% (Supplies Count) to the Total Supplies Purchases.

Calculation: % of Diff. >= 25% and < 50% (Supplies Percentage) = (% of Diff. >= 25% and < 50% (Supplies Count) / Total Supplies Purchases) * 100