Understanding the Fixed Asset Changes Report

* The Fixed Asset Changes report is made available now to anyone who attends the Fixed Asset Year End Class and is available for purchase through your Account Manager at eainsidesales@ecisolutions.com.

If you are using e-automate's Fixed Asset module to track fixed asset transaction data in e-automate, you can process a Fixed Asset Changes Report to show the fixed asset changes that have occurred within a specified time frame and to verify balance information when reconciling by asset codes or by General Ledger accounts.

You can filter the report by date/period, asset, asset code, General Ledger account, branch, and/or balance sheet group ranges. You can group fixed asset change data by asset code or by asset GL account. You can generate a summary report, detail report, or detail for export report.

Depending upon the format and group-by options you select, the main report includes the following information:

Summary Format:

Header: Company Name, Report Name, Report Parameters (may include Assets, Asset Codes, GL Accounts, Branches, Balance Sheet Groups, Group By, Format), Printed Date and Time, Printed By

Detail Rows: Asset Code (if grouping by Asset Code) or Asset GL Account (if grouping by Asset GL Account), Cost Begin Balance, Cost End Balance, Cost Change, Accumulated Depreciation Begin Balance, Accumulated Depreciation End Balance, Accumulated Depreciation Change, Net Begin Balance, Net End Balance, Net Change

Totals Row: Cost Begin Balance, Cost End Balance, Cost Change, Accumulated Depreciation Begin Balance, Accumulated Depreciation End Balance, Accumulated Depreciation Change, Net Begin Balance, Net End Balance, Net Change

Detail Format:

Header: Company Name, Report Name, Report Parameters (may include Assets, Asset Codes, GL Accounts, Branches, Balance Sheet Groups, Group By, Format), Printed Date and Time, Printed By

Detail Rows: Asset Number, Asset Code (if grouping by Asset Code) or Asset GL Account (if grouping by Asset GL Account), DRP (Depreciation Recovery Period), Acquired Date, Disposed Date, Cost Begin, Cost End, Change, Accumulated Depreciation Begin, Accumulated Depreciation End, Change, Net Begin, Net End, Change

Sub Total Row: Asset Code (if grouping by Asset Code) or Asset GL Account (if grouping by Asset GL Account), Cost Begin, Cost End, Change, Accumulated Depreciation Begin, Accumulated Depreciation End, Change, Net Begin, Net End, Change

Grand Total Row: Cost Begin, Cost End, Change, Accumulated Depreciation Begin, Accumulated Depreciation End, Change, Net Begin, Net End, Change

Detail for Export Format:

Header: Company Name, Report Name, Report Parameters (may include Assets, Asset Codes, GL Accounts, Branches, Balance Sheet Groups, Group By, Format), Printed Date and Time, Printed By

Detail Rows: Asset No., Code, DRP (Depreciation Recovery Period), Acquired, Activated, GL, Begin Cost, Disposed, Cost End Bal, Cost Change, Accum Beg Bal, Accum End Bal, Accum Change, Net Begin, Net End Bal, Net Change, Description, Serial, Depreciation Through Date, Method, Convention, Depr Cycle, Salvage Value, Market Value, Asset Code, Location, Branch, Warehouse, Bin

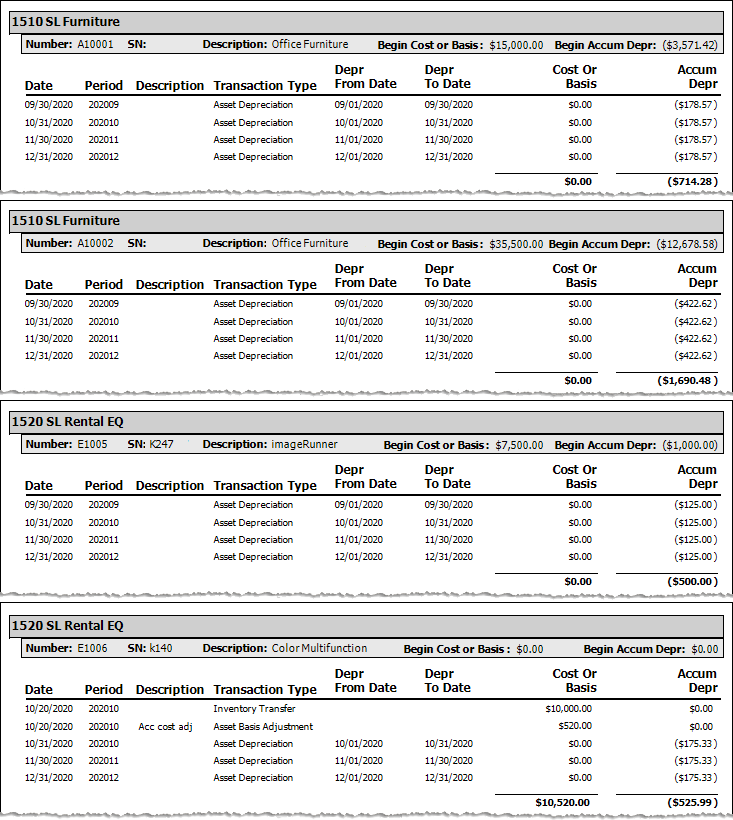

The report's Detail Format offers drill-down capabilities. By clicking on blue text, you can view a Fixed Asset Transaction sub report containing data for a selected fixed asset about each transaction that occurred within the date/period range you specified for the report. The system opens the sub report in a separate tab. The sub report contains the following information:

Header: Asset Code, Asset Number, Serial Number, Description, Begin Cost or Basis, Begin Accumulated Depreciation

Detail Rows: Date, Period, Description, Transaction Type, Depreciation From Date, Depreciation To Date, Cost or Basis, Accumulated Depreciation

Total Row: Cost or Basis, Accumulated Depreciation

Getting to the ReportGetting to the Report

Log in to e-automate with the appropriate permissions.

Click [Reports] to open the Report Console window.

In the left pane, click All reports or Custom reports. The system displays the report list in the right pane.

In the right pane, double-click Fixed Asset Changes to open the Fixed Asset Changes window.

Setting Report ParametersSetting Report Parameters

When setting report parameters, each parameter you have selected displays in the upper portion of the right pane. The parameters do not reset. The report displays with the parameters that were set the last time you ran the report. This report includes parameters you can modify as well as some fixed parameters taken from the separate reports upon which this consolidated report is based.

Date/PeriodDate/Period

To filter by date or period, do the following:

In the left pane of the Fixed Asset Changes window, select Date/Period to display the Date/Period region in the right pane.

Do one of the following:

To filter based on date, do the following:

Select the Dates radio button.

Do one of the following:

To include all dates, in the Dates region, use the drop-down menu to select <All Dates>.

To use a pre-defined date range, in the Dates region, use the drop-down menu to select a pre-configured date option (e.g., This Month to Date).

To specify a custom date range, do the following:

In the Dates region, use the drop-down menu to select <Custom>.

In the From field, enter the beginning date or use the drop-down calendar to select a date from which to have the system include fixed asset transaction data in the report.

In the To field, enter the ending date or use the drop-down calendar icon to select a date through which to have the system include fixed asset transaction data in the report.

To filter based on period, do one of the following:

Select the Periods radio button.

Do one of the following:

To include all periods, in the Periods region, use the drop-down menu to select <All Periods>.

To use a pre-defined date range, in the Periods region, use the drop-down menu to select a pre-configured period option (e.g., This Period).

To specify a custom period range, do the following:

In the Periods region, use the drop-down menu to select <Custom>.

In the From field, enter the month and year identifying the beginning period from which to have the system include fixed asset transaction data in the report.

In the To field, enter the month and year identifying the ending period through which to have the system include fixed asset transaction data in the report.

AssetsAssets

To filter by assets, do the following:

In the left pane of the Fixed Asset Changes window, select Assets to display the Assets region in the right pane.

Do one of the following:

If you want to include all assets, in the Assets region, check the Include all Assets checkbox.

If you want to select a range of assets, do the following:

Uncheck the Include all Assets checkbox.

In the From field, enter the beginning asset number or use the lookup icon to select an asset.

In the To field, enter the ending asset number or use the lookup icon to select an asset.

If you want to select one or more assets using the advanced filter, do the following:

Uncheck the Include all Assets checkbox.

Check the Use advanced filter box.

Click the [Advanced filter] button to open the Assets window.

Use the QuickSearch functionality to filter for the asset(s) you want to include in the report. For information on using QuickSearch functionality, see the Using the QuickSearch topic.

When the Assets window displays the asset(s) you want to include in the report, click [OK] to return to the Fixed Asset Changes window.

Asset CodesAsset Codes

To filter by asset codes, do the following:

In the left pane of the Fixed Asset Changes window, select Asset Codes to display the Asset Codes region in the right pane.

Do one of the following:

If you want to include all asset codes, in the Asset Codes region, check the Include all Asset Codes checkbox.

If you want to select a range of asset codes, do the following:

Uncheck the Include all Asset Codes checkbox.

In the From field, enter the beginning asset code or use the lookup icon to select an asset code.

In the To field, enter the ending asset code or use the lookup icon to select an asset code.

If you want to select one or more asset codes using the advanced filter, do the following:

Uncheck the Include all Asset Codes checkbox.

Check the Use advanced filter box.

Click the [Advanced filter] button to open the Asset Codes window.

Use the QuickSearch functionality to filter for the asset code(s) you want to include in the report. For information on using QuickSearch functionality, see the Using the QuickSearch topic.

When the Asset Codes window displays the asset code(s) you want to include in the report, click [OK] to return to the Fixed Asset Changes window.

GL AccountsGL Accounts

To filter by GL accounts, do the following:

In the left pane of the Fixed Asset Changes window, select GL Accounts to display the GL Accounts region in the right pane.

Do one of the following:

If you want to include all GL accounts, in the GL Accounts region, check the Include all GL Accounts checkbox.

If you want to select a range of GL accounts, do the following:

Uncheck the Include all GL Accounts checkbox.

In the From field, enter the beginning GL account or use the lookup icon to select a GL account.

In the To field, enter the ending GL account or use the lookup icon to select a GL account.

If you want to select one or more GL accounts using the advanced filter, do the following:

Uncheck the Include all GL Accounts checkbox.

Check the Use advanced filter box.

Click the [Advanced filter] button to open the GL Accounts window.

Use the QuickSearch functionality to filter for the GL account(s) you want to include in the report. For information on using QuickSearch functionality, see the Using the QuickSearch topic.

When the GL Accounts window displays the GL account(s) you want to include in the report, click [OK] to return to the Fixed Asset Changes window.

BranchesBranches

To filter by branches, do the following:

In the left pane of the Fixed Asset Changes window, select Branches to display the Branches region in the right pane.

Do one of the following:

If you want to include all branches, in the Branches region, check the Include all Branches checkbox.

If you want to select a range of branches, do the following:

Uncheck the Include all Branches checkbox.

In the From field, enter the beginning branch or use the lookup icon to select a branch.

In the To field, enter the ending branch or use the lookup icon to select a branch.

Balance Sheet GroupsBalance Sheet Groups

To filter by balance sheet group, do the following:

In the left pane of the Fixed Asset Changes window, select Balance Sheet Groups to display the Balance Sheet Groups region in the right pane.

Do one of the following:

If you want to include all balance sheet groups, in the Balance Sheet Groups region, check the Include all Balance Sheet Groups checkbox.

If you want to select a range of balance sheet groups, do the following:

Uncheck the Include all Balance Sheet Groups checkbox.

In the From field, enter the beginning balance sheet group number or use the lookup icon to select a balance sheet group.

In the To field, enter the ending balance sheet group number or use the lookup icon to select a balance sheet group.

Group ByGroup By

To set a group-by option, do the following:

In the left pane of the Fixed Asset Changes window, select Group By to display the Group By region in the right pane.

Do ONE of the following:

Select Asset Code to include asset codes on detail rows, to group detail rows by asset code, and to provide sub totals for each asset code included in the report.

Select Asset GL Account to include asset GL accounts on detail rows, to group detail rows by asset GL account, and to provide sub totals for each asset GL account included in the report.

Note: If you set Format to Detail for export, the system does not apply the Group By selection to the report.

FormatFormat

To set a format option, do the following:

In the left pane of the Fixed Asset Changes window, select Format to display the Format region in the right pane.

Do ONE of the following:

Select Summary to include the following information in the report:

Header: Company Name, Report Name, Report Parameters (may include Assets, Asset Codes, GL Accounts, Branches, Balance Sheet Groups, Group By, Format), Printed Date and Time, Printed By

Detail Rows: Asset Code (if grouping by Asset Code) or Asset GL Account (if grouping by Asset GL Account), Cost Begin Balance, Cost End Balance, Cost Change, Accumulated Depreciation Begin Balance, Accumulated Depreciation End Balance, Accumulated Depreciation Change, Net Begin Balance, Net End Balance, Net Change

Totals Row: Cost Begin Balance, Cost End Balance, Cost Change, Accumulated Depreciation Begin Balance, Accumulated Depreciation End Balance, Accumulated Depreciation Change, Net Begin Balance, Net End Balance, Net Change

Select Detail to include the following information in the report:

Header: Company Name, Report Name, Report Parameters (may include Assets, Asset Codes, GL Accounts, Branches, Balance Sheet Groups, Group By, Format), Printed Date and Time, Printed By

Detail Rows: Asset Number, Asset Code (if grouping by Asset Code) or Asset GL Account (if grouping by Asset GL Account), DP (Depreciation/Recovery Period), Acquired Date, Disposed Date, Cost Begin, Cost End, Change, Accumulated Depreciation Begin, Accumulated Depreciation End, Change, Net Begin, Net End, Change

Sub Total Rows: Asset Code (if grouping by Asset Code) or Asset GL Account (if grouping by Asset GL Account), Cost Begin, Cost End, Change, Accumulated Depreciation Begin, Accumulated Depreciation End, Change, Net Begin, Net End, Change

Grand Total Row: Cost Begin, Cost End, Change, Accumulated Depreciation Begin, Accumulated Depreciation End, Change, Net Begin, Net End, Change

Select Detail for export to include the following information in the report:

Header: Company Name, Report Name, Report Parameters (may include Assets, Asset Codes, GL Accounts, Branches, Balance Sheet Groups, Group By, Format), Printed Date and Time, Printed By

Detail Rows: Asset No., Code, DRP (Depreciation Recovery Period), Acquired, Activated, GL, Begin Cost, Disposed, Cost End Bal, Cost Change, Accum Beg Bal, Accum End Bal, Accum Change, Net Begin, Net End Bal, Net Change, Description, Serial, Depreciation Through Date, Method, Convention, Depr Cycle, Salvage Value, Market Value, Asset Code, Location, Branch, Warehouse, Bin

Note: If you need branch information as part of the report, only the Detail for export format provides branch information.

Note: When you process a Fixed Asset Changes report with Format set to Detail for export, the system displays a Crystal Report window displaying the report data for export. To export the data, see the "Exporting Report Data" section of this topic.

Processing the ReportProcessing the Report

On the Fixed Asset Changes window, click [OK] to process the report.

Viewing a Sub ReportViewing a Sub Report

Using the main report's drill-down capabilities, you can view a Fixed Asset Transaction sub report containing data for a selected fixed asset about each transaction that occurred within the date/period range you specified for the report.

To be able to view a Fixed Asset Transaction sub report, you must process the main report with Format set to Detailed.

To view a Fixed Asset Transaction sub report, click an asset number in blue font in the Number column of the main report.

Understanding Report CalculationsUnderstanding Report Calculations

Main ReportMain Report

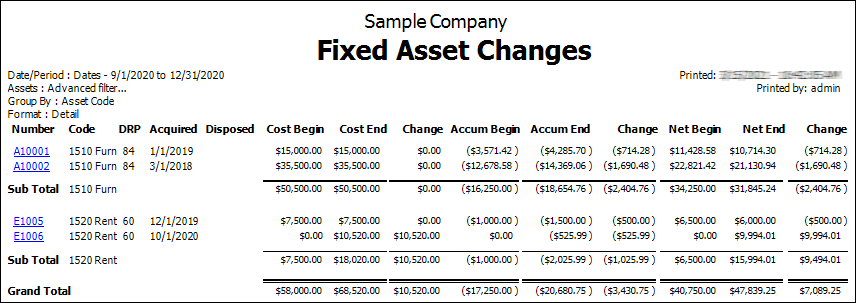

Following is an excerpt of the main Fixed Asset Changes report. This report excerpt was processed with Group By set to Asset Code. Had the report been processed with Group By set to Asset GL Account, the system would have listed the asset GL accounts in the Code column, sequenced the detail rows by asset GL account, and displayed sub-total rows for each asset GL account.

Note: To jump to a specific calculation, click a number in the sample report image. For the links within this topic to work, you must click the online help's [Expand All] button; the browser will not display a link in content that is hidden.

Note: This sample report and the related sub reports are designed for the sole purpose of illustrating multiple calculation scenarios; they are not intended to represent a realistic or best practices portrayal of fixed asset change activity.

Main Report Image

The following table identifies the source of each of the numbers and/or the calculations for arriving at the numbers in the main Fixed Asset Changes report.

|

Report Label |

Calculations |

|

The asset Number assigned to the fixed asset's Fixed Asset record. To access the Fixed Asset Transaction sub report for a fixed asset, click the number in blue font in this column. For sample Fixed Asset Transaction sub report calculation information, see the Fixed Asset Transaction Sub Report section of this topic. |

|

|

The Asset code description associated with the Asset code assigned to the fixed asset's Fixed Asset record. |

|

|

The Asset GL account associated with the Asset code assigned to the fixed asset's Fixed Asset record. |

|

|

The number of months listed in the Recovery period (months) field in the fixed asset's Fixed Asset record. The depreciation recovery period is the total number of months over which you intend to depreciate the fixed asset. |

|

|

The date on which your company acquired the fixed asset. |

|

|

The date on which your company disposed of the fixed asset as recorded in the Disposal date field of the fixed asset's Fixed Asset record when the checkbox associate with the Disposal date field is checked. |

|

|

The value associated with a fixed asset as of the first day of the reporting period. The original value is listed in the Cost or basis field of each fixed asset's Fixed Asset record. Begin Cost or Basis for Asset Number A10001 = $15,000.00 |

|

|

The value associated with a fixed asset as of the last day of the reporting period. This value is calculated by adding the fixed asset's Cost Begin and Cost Change amounts.

Calculation: Cost End = Cost Begin + Cost Change

Example (based on Sub Main image): Cost End for Asset Number A10001 = $15,000.00 Begin Cost or Basis for Asset Number A10001 + $0.00 Cost Change = $15,000.00 |

|

|

The sum of the Asset Basis Adjustment and/or Inventory Adjustment transactions associated with the fixed asset during the reporting period. To see the fixed asset transaction details, click the number in blue font in the Number column of the main report to access the Fixed Asset Transaction sub report.

Calculation: Change (Cost) = Sum(Asset Basis Adjustment and/or Inventory Adjustment Transactions for Fixed Asset during Reporting Period)

Example (based on Main Report image): Total Cost or Basis Transaction Amounts Recorded for Asset Number A10001 = $0.00 + $0.00 + $0.00 + $0.00 = $0.00 |

|

|

The total amount of depreciation already posted for the asset as of the beginning of the reporting period. Beginning Accumulated Depreciation for Asset Number A10001 = ($3,571.42) |

|

|

The total amount of depreciation posted for the asset as of the last day of the reporting period. This value is calculated by adding the fixed asset's Accum Begin (Beginning Accumulated Depreciation) and Accum Change (Accumulated Depreciation Change) amounts during the reporting period.

Calculation: Accum End = Accum Begin + Accum Change during Reporting Period

Example (based on Sub Main image): Accum End for Asset Number A10001 = ($3,571.42) Accum Begin for Asset Number A10001 + ($714.28) Accum Change = ($4,285.70) |

|

|

The sum of the Asset Depreciation transaction amounts associated with the fixed asset during the reporting period.

Calculation: Change (Accumulated Depreciation) = Sum (Accumulated Depreciation Transaction Amounts Recorded for Fixed Asset during Reporting Period)

Example (based on Sub Report image): Total Accum Depr Transaction Amounts Recorded for Asset Number A10001 = ($178.57) + ($178.57) + ($178.57) + ($178.57) = ($714.28) |

|

|

The sum of the Cost Begin and Accum Begin amounts for the fixed asset during the reporting period.

Calculation: Net Begin = Sum (Cost Begin + Accum Begin for Fixed Asset during Reporting Period)

Example (based on Sub Report image): Net Begin for Asset Number A10001 = $15,000.00 Cost Begin + ($3,571.42) Accum Begin = $11,428.58 |

|

|

The sum of the Cost End and Accum End amounts for the fixed asset during the reporting period.

Calculation: Net End = Sum (Cost End + Accum End for Fixed Asset during Reporting Period)

Example (based on Sub Report image): Net End for Asset Number A10001 = $15,000.00 Cost End + ($4,285.70) Accum End = $10,714.30 |

|

|

The sum of the Change (Cost) and Change (Accumulated Depreciation) amounts for the fixed asset during the reporting period.

Calculation: Change (Net) = Sum (Cost Change + Accum Depr Change for Fixed Asset during Reporting Period)

Example (based on Sub Report image): Change (Net) for Asset Number A10001 = $0.00 Cost Change + ($714.28) Accum Depr Change = ($714.28) |

|

|

The Asset code description associated with a group of fixed asset included in the report. |

|

|

Sub Total Asset GL Account |

The Asset GL Account associated with a group of fixed asset included in the report. |

|

The sum of the Cost Begin values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report.

Calculation: Sub Total Cost Begin = Sum (Cost Begin Values for Asset Code or Asset GL Account)

Example (based on Main Report image): Sub Total Cost Begin for Asset Code 1510 Furn = $15,000.00 for Asset Number A10001 + $35,500.00 for Asset Number A10002 = $50,500.00 |

|

|

The sum of the Cost End values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report.

Calculation: Sub Total Cost End = Sum (Cost End Values for Asset Code or Asset GL Account)

Example (based on Main Report image): Sub Total Cost End for Asset Code 1510 Furn = $15,000.00 for Asset Number A10001 + $35,500.00 for Asset Number A10002 = $50,500.00 |

|

|

The sum of the Cost Change values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report.

Calculation: Sub Total Cost Change = Sum (Cost Change Values for Asset Code or Asset GL Account)

Example (based on Main Report image): Sub Total Cost Change for Asset Code 1510 Furn = $0.00 for Asset Number A10001 + $0.00 for Asset Number A10002 = $0.00 |

|

|

The sum of the Accum Begin values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report.

Calculation: Sub Total Accum Begin = Sum (Accum Begin Values for Asset Code or Asset GL Account)

Example (based on Main Report image): Sub Total Accum Begin for Asset Code 1510 Furn = ($3,571.42) for Asset Number A10001 + ($12,678.58) for Asset Number A10002 = ($16,250) |

|

|

The sum of the Accum End values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report.

Calculation: Sub Total Accum End = Sum (Cost End Values for Asset Code or Asset GL Account)

Example (based on Main Report image): Sub Total Accum End for Asset Code 1510 Furn = ($4,285.70) for Asset Number A10001 + ($14,369.06) for Asset Number A10002 = ($18,654.76) |

|

|

The sum of the Accumulated Depreciation Change values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report.

Calculation: Sub Total Accum Depr Change = Sum (Accum Depr Change Values for Asset Code or Asset GL Account)

Example (based on Main Report image): Sub Total Accum Depr Change for Asset Code 1510 Furn = ($714.28) for Asset Number A10001 + ($1,690.48) for Asset Number A10002 = ($2,404.76) |

|

|

The sum of the Net Begin values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Sub Total Net Begin = Sum (Net Begin Values for Asset Code or Asset GL Account) Example (based on Main Report image): Sub Total Net Begin for Asset Code 1510 Furn = $11,428.58 for Asset Number A10001 + $22,821.42 for Asset Number A10002 =$34,250.00 |

|

|

The sum of the Net End values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Sub Total Net End = Sum (Net End Values for Asset Code or Asset GL Account) Example (based on Main Report image): Sub Total Net End for Asset Code 1510 Furn = $10,714.30 for Asset Number A10001 + $21,130.94 for Asset Number A10002 = $31,845.24 |

|

|

The sum of the Net Change values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Sub Total Net Change = Sum (Net Change Values for Asset Code or Asset GL Account) Example (based on Main Report image): Sub Total Net Change for Asset Code 1510 Furn = ($714.28) for Asset Number A10001 + ($1,690.48) for Asset Number A10002 = ($2,404.76) |

|

|

The sum of the Cost Begin Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Cost Begin = Sum (Cost Begin Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Cost Begin = $50,500.00 for Asset Code 1510Furn +$7,500.00 for Asset Code 1520 RentEQ = $58,000.00 |

|

|

The sum of the Cost End Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Cost End = Sum (Cost End Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Cost End = $50,500.00 for Asset Code 1510Furn + $18,020.00 for Asset Code 1520 RentEQ = $68,520.00 |

|

|

The sum of the Cost Change Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Cost Change = Sum (Cost Change Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Cost Change = $0.00 for Asset Code 1510Furn + $10,520.00 for Asset Code 1520 RentEQ = $10,520.00 |

|

|

The sum of the Accum Begin Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Accum Begin = Sum (Accum Begin Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Accum Begin = ($16,250.00) for Asset Code 1510Furn + ($1,000.00) for Asset Code 1520 RentEQ = ($17,250.00) |

|

|

The sum of the Accum End Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Accum End = Sum (Cost End Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Accum End = ($18,654.76) for Asset Code 1510Furn + ($2,025.99) for Asset Code 1520 RentEQ = ($20,680.75) |

|

|

The sum of the Accumulated Depreciation Change Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Accum Depr Change = Sum (Accum Depr Change Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Accum Depr Change = ($2,404.76) for Asset Code 1510Furn + ($1,025.99) for Asset Code 1520 RentEQ = ($3,430.75) |

|

|

The sum of the Net Begin Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Net Begin = Sum (Net Begin Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Net Begin = $34,250.00 for Asset Code 1510Furn + $6,500.00 for Asset Code 1520 RentEQ = $40,750.00 |

|

|

The sum of the Net End Sub Totals for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Net End = Sum (Net End Sub Total Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Net End for Asset Code 1510 Furn = $31,845.24 for Asset Code 1510Furn + $15,994.01 for Asset Code 1520 RentEQ = $47,839.25 |

|

|

The sum of the Net Change values for the Asset Code or Asset GL Account (depending upon report Group By selection) included in the report. Calculation: Grand Total Net Change = Sum (Net Change Values for Asset Code or Asset GL Account) Example (based on Main Report image): Grand Total Net Change = ($2,404.76) for Asset Code 1510Furn + $9,494.01 for Asset Code 1520 RentEQ = $7,089.25 |

Fixed Asset Transaction Sub ReportFixed Asset Transaction Sub Report

Following are the sample Fixed Asset Transaction sub reports associated with the sample Main report.

Fixed Asset Transaction Sub Report

The following table identifies the source of each of the numbers and/or the calculations for arriving at the Cost Begin, Cost Change, Accum Begin, and Accum Change values displayed on the main Fixed Asset Changes report for the selected Asset Number.

|

Report Label |

Calculations |

|

The Asset code description associated with the Asset code assigned to the fixed asset's Fixed Asset record. |

|

|

The asset Number assigned to the fixed asset's Fixed Asset record. |

|

|

The Serial number—if any—assigned to the fixed asset's Fixed Asset record. |

|

|

The Description assigned to the fixed asset's Fixed Asset record.. Description of 10/20/2020 Asset Basis Adjustment for E1006: An asset basis cost adjustment was made to account for added accessories (Acc cost adj). |

|

|

The value associated with a fixed asset as of the first day of the reporting period. The original value is listed in the Cost or basis field of each fixed asset's Fixed Asset record. Begin Cost or Basis for Asset Number A10001 = $15,000.00 |

|

|

The amount of depreciation already posted for the asset as of the beginning of the reporting period. Begin Accumulated Depreciation for Asset Number A10001 = ($3,571.42) |

|

|

The calendar date on which the transaction occurred. |

|

|

The 4-digit year and 2-digit period of that year that identify the accounting period in which the transaction occurred. |

|

|

The description, if any, associated with the Fixed Asset Transaction record. |

|

|

The type of fixed asset cost adjustment (i.e., Asset Depreciation, Asset Basis Adjustment) or inventory adjustment (i.e., Inventory Transfer) that the row represents. |

|

|

The first date of the depreciation period to which the transaction applies. |

|

|

The last date of the depreciation period to which the transaction applies. |

|

|

The amount of a transaction that represents the original value associated with the fixed asset. This amount may be an Asset Basis Adjustment (e.g., a beginning balance, not shown in the sample sub reports) or an Inventory Adjustment such as an inventory transfer amount. Cost or Basis for Asset Number E1006 on 10/20/2020 = $10,000.00 Inventory Transfer |

|

|

The amount of a transaction that represents accumulated depreciation of a fixed asset. This amount may be an Asset Basis Adjustment such as a beginning balance (not shown in the sample sub reports) or an Asset Depreciation amount. Accumulated Depreciation for Asset Number A10001 for each Transaction = ($178.57) |

|

|

The sum of the values in the Cost or Basis column for a fixed asset.

Calculation: Total Cost or Basis = Sum (Cost or Basis Transaction Amounts Recorded for Fixed Asset within Reporting Period)

Example (based on Sub Report image): Total Cost or Basis Transaction Amounts Recorded for Asset Number A10001 = $0.00 + $0.00 + $0.00 + $0.00 = $0.00 |

|

|

The sum of the values in the Accum Depr column for a fixed asset.

Calculation: Total Accum Depr = Sum (Accumulated Depreciation Transaction Amounts Recorded for Fixed Asset within Reporting Period)

Example (based on Sub Report image): Total Accum Depr Transaction Amounts Recorded for Asset Number A10001 = ($178.57) + ($178.57) + ($178.57) + ($178.57) = ($714.28) |

Exporting Report DataExporting Report Data

Note: While you can export any report, processing a report with the Format option set to Detail for export will generate a table of data that can easily be exported to an Excel spreadsheet.

To export a generated report's data, do the following:

On the Crystal Report window's toolbar, click the ![]() Export Report icon. The system displays an Export Report window.

Export Report icon. The system displays an Export Report window.

Using the Export Report window, do the following:

Navigate to the location where you want to save the report.

In the File name field, enter a name for the report.

In the Save as type field, use the drop-down menu to select the type of file you want the system to create (e.g., Microsoft Excel...).

Click the [Save] button. The system displays a spinner and a "Please wait while the document is processing" message.

When the process completes, the system displays an "Export Report: Export completed" message. Click [OK] to acknowledge the message and to close the Export Report window.

Non-supported ReleaseNon-supported Release

©2022 ECI and the ECI logo are registered trademarks of ECI Software Solutions, Inc. All rights reserved.