Configuring Credit Card Processing Settings

To batch process credit cards in e-automate, you must have a merchant service. The processor integrated with e-automate is NET1 Payment Solutions, https://www.ecisolutions.com/business-applications/net1. NET1 Payment Solutions is a PCI-DSS compliant, third-party partner with e-automate. If you do not have an agreement with our credit card processor, NET1 Payment Solutions, you cannot bulk process credit card or manual payments. If you have an authorized credit card partner other than NET1 Payment Solutions, you will need to use the Process Customer Charge Accounts window to manually process credit cards individually.

Note: NET1 Payment Solutions supports Level 3 credit card processing. No additional configuration is required to receive a discounted Level 3 interchange rate when accepting a credit card order. Typically, this discount applies when:

A business-to-business (B2B) or business-to-government (B2G) transaction is made using a business or government purchase card.

The card is a MasterCard or Visa.

For MasterCard, the transaction is not a non-taxable (tax-exempt) transaction.

The business or government purchase card is added to the NET1 Payment Solutions credit card vault (required to maintain PCI compliance during processing).

Note: Any transaction paid using the Single use account credit card processing option cannot qualify for Level 3 credit card processing; to maintain PCI-compliance, it is not possible to process the detail necessary to qualify for the Level 3 discount using a credit card that is not stored in the NET1 Payment Solutions credit card vault.

Whether a single payment is made for one invoice or many invoices, each invoice (service, contract, sales, miscellaneous, or POS) included in the transaction is paid in full.

Note: If a transaction includes a partial payment of any invoice—even if one or more other invoices are paid in full as part of the same payment transaction—the transaction does not qualify for Level 3 credit card processing.

Sufficient transaction-level and line-item detail is captured to qualify the transaction for Level 3 credit card processing.

When these conditions are met (along with Level 1 and Level 2 requirements), the merchant will automatically apply the discounted Level 3 interchange rate associated with accepting the credit card order. You will be able to determine if a transaction received the Level 3 discount as follows:

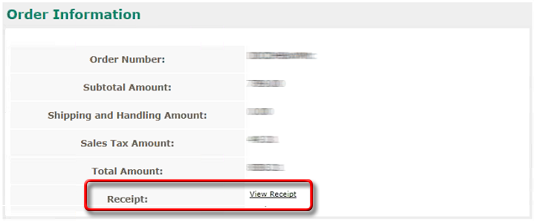

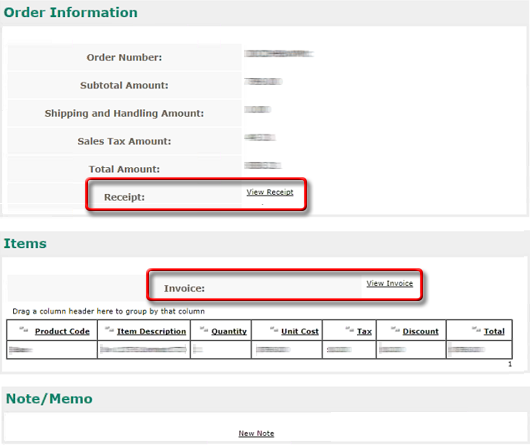

Using your NET1 Payment Solutions virtual terminal, you can access the transaction in real time. If the transaction displays only as a receipt on the sale, the transaction did not qualify for Level 3 processing.

If the transaction displays as a receipt and an invoice, the transaction did qualify for Level 3 processing.

Note: During processing, NET1 Payment Solutions filters the data certain fields may contain. As a result, you may notice differences between the data displayed in the NET1 Payment Solutions Virtual Terminal and the corresponding data in your e-automate system. For example, NET1 Payment Solutions may limit a field to 12 characters in length and may permit the field to contain only the following characters: 0-9 a-z A-Z _ - ' . , # /. If the corresponding field in your e-automate system contains more than 12 characters and/or contains other types of characters not included in this list, NET1 Payment Solutions will remove the additional characters during processing before displaying the data (e.g., if NET1 Payment Solutions applies this filter to an e-automate field value of #~Abcdefghijklmn%, the NET1 Payment Solutions would display the value as #Abcdefghijk). The presence of any additional characters in your e-automate data does not have any impact on credit card processing, and the system does not alter the corresponding data in your e-automate system during processing.

Your monthly merchant statement will display one of the following:

Data Rate 3 for MasterCard

Purchase Card Level 3 for Visa

Getting to the TransactionGetting to the Transaction

From the Tools menu, select Options to open the Options window.

In the left pane, click [+] next to Sales to expand the menu.

Under Sales select Credit Card Processing to display the Credit Card Processing options in the right pane.

Basic InformationBasic Information

Enter the appropriate selections in the following fields:

Require name on card: When checked, the system requires an entry in the Name on account field during entry of charge account information.

Note: Since all credit card transactions require the cardholder’s name, the system checks this box by default and it cannot be unchecked.

Require address, city, and state: When checked, the system requires an entry in the Address, City, and State fields during entry of charge account information.

Note: If you set Credit card vault to NET1, the system checks and disables this box because NET1 Payment Solutions requires entries in these fields. If you set Credit card vault to Reference Only, the system enables this box, allowing you to check/uncheck this box as appropriate.

Require zip code: When checked, the system requires an entry in the Zip field during entry of charge account information.

Note: Since all credit card transactions require the cardholder’s zip code, the system checks this box by default and it cannot be unchecked.

Processing payments before scheduled date: Select one of the following:

Note: This section applies to payments scheduled via e-info; when an e-info user schedules a payment, the e-info user can specify a future date on which the credit card transaction is to occur.

Allow: Permit processing of a credit card payment before the scheduled date associated with the payment in e-info. Do not display a warning to indicate that the scheduled payment date is in the future.

Warn: Issue a warning if an e-automate user attempts to process a credit card payment before the scheduled date associated with the payment in e-info, but permit the user to process the credit card payment before the scheduled date.

Do not allow: Prevent a credit card payment scheduled via e-info from being processed before the scheduled date associated with the payment.

Credit card vault: Use the lookup to select one of the following options for your company’s credit card processing system:

NET1: NET1 Payment Solutions is a PCI-compliant, third-party partner with e-automate.

Reference Only: This options allows you to process credit cards without requiring accounts. If you select this option, proceed to Step 3.

If you set Credit card vault to NET1 in the previous step, click [Configuration settings] to add your NET1 Payment Solutions account information.

Note: If you set Credit card vault to Reference Only in the previous step, proceed to Step 3; the Reference Only selection does not require any vault configuration settings.

Enter the appropriate information in the following fields:

Merchant ID: Your company’s unique merchant ID provided to you by NET1 Payment Solutions.

Merchant key:Your company’s unique merchant key provided to you by NET1 Payment Solutions.

Originator ID:Your company’s unique originator ID provided to you by NET1 Payment Solutions.

Note: This is only used for ACH transactions.

EIN: Your company’s EIN number.

Note: This is only used for ACH transactions.

Click [OK] to save your NET1 Payment Solutions account settings and to return to the Credit Card Processing Options window.

Enter the appropriate information:

Allow credits to be issued without reference to originally charged invoice: When not checked, you are required to locate the original invoice to issue a credit.

Require pre-authorization on service calls with charge accounts: When checked, e-automate requires NET1 Payment Solutions to secure a deposit authorization on the credit card for all service calls with the charge method of Credit Card.

Service call pre-authorization amount: The monetary amount of the pre-authorization. NET1 Payment Solutions authorizes this amount temporarily on the credit card until the exact amount of the service call is identified.

Batch processing password: An e-automate password that is required when processing large batches of credit card transactions in the Process Customer Charge Accounts window. (Accounting > Accounts receivable > Process customer charge accounts). This is present to prevent the accidental processing of large batches of credit card transactions. You can leave this field blank and no password will be required for enabled users. If you enter a password, e-automate requires that password be entered before a batch credit cards are electronically passed to the merchant processor for processing. There are no restrictions on this field, you are welcome to enter any password you like and will only be required on batch processing.

Retype batch processing password: Verification of the value entered in the Batch processing password field. The Batch processing password field must be identical to the Retype batch processing password field in order for batch credit card processing to be passed to your merchant for processing.

Completing the TransactionCompleting the Transaction

Click [OK] to save the Credit Card Processing options.

Note: You must restart e-automate before these changes will take effect. If you are running e-agent, you must restart e-agent as well.

Understanding Mailing Addresses Used in Credit Card ProcessingUnderstanding Mailing Addresses Used in Credit Card Processing

Shipping Addresses:

If a customer uses a credit card to make a prepayment (a charge not associated with an invoice), the system uses the Physical address in the Customer record as the shipping address.

If a customer uses a credit card to pay a single invoice or to pay multiple invoices that all have the same shipping address, the system uses the shipping address associated with the invoice(s).

If the customer uses a credit card to pay multiple invoices associated with two or more shipping address, the Paya Virtual Terminal will display each shipping address as "- -" and will list "Multiple" in the Customer Name field.

Billing Addresses:

The system will always use the billing address associated with the charge account as the billing address for the credit card transaction.

Whether you are processing a credit card transaction using an existing account (where the charge account information is stored in the NET1/Paya credit card vault) or a credit card transaction using a single use account (where you enter credit card information via the Single Use Charge Account window), the billing address information you enter for the charge account must match the billing address information the credit card company has on file for the charge account.

Emailing Credit Card ReceiptsEmailing Credit Card Receipts

If you specify an Accounts receivable contact on the Contacts tab in the Customer record of the bill-to customer for whom you process a credit card transaction that qualifies for the discounted Level 3 interchange rate AND the Contact record for that contact contains an Email address on the Profile tab, the system will include the contact's e-mail address with the data sent to NET1 Payment Solutions for processing and NET1 Payment Solutions will automatically email a receipt to the accounts receivable contact for the credit card transaction that qualified for the discounted Level 3 interchange rate.

Non-supported ReleaseNon-supported Release

©2022 ECI and the ECI logo are registered trademarks of ECI Software Solutions, Inc. All rights reserved.